What was remembered for 2021 at the Russian insurance market

We decided to summarize the outgoing 2021 years with Lebedev Denis an expert of the insurance market and the founder of the Calmins.com resource – a deliberate insurance.

After 2020, which passed in a pandemic and lockdown, 2021 met us more optimistic. We allocated 10 key points, in some cases even trends that occurred in the insurance market and may have remote consequences of a different nature.

For simple navigation, we have made for you convenient content of the article:

- Rapid growth of the insurance market 2021 contrary to forecasts;

- High profits of the insurance market in 2020;

- Exit from the market of a number of insurers;

- Foreign insurers in Russia: when they are waited;

- Renaissance insurance and IPO;

- Rosgosstrakh and insurance in Russia – 100 years;

- Expectations on growth of the Internet channel sales during the next 5 years;

- 710-P: how insurers to survive;

- Third party liability insurance: what has changes in 2021 and what will change in 2022;

- Struggle for life: what is waiting of the insurance market in 2022.;

1. The rapid growth of the insurance market is more than 20% contrary to conservative forecasts – 5-10%

Despite the lack of falling insurance premiums in 2020 (although expectations for its fall reached minus 15-20% to the results of 2019), 2021 showed rapid growth. Growth drivers have become life insurance (accumulative life insurance and investment life insurance), credit insurance. It is important to note that investment life insurance has ceased fall (last 3 years) and has passed into a positive recovery phase. Almost all business lines showed significant growth, contrary to the initial conservative forecasts at the level of 5-10%. According to forecasts, the total amount of the accrued premium in 2021 will exceed 1.8 trillion rubles, and on life insurance – 550 billion rubles.

The concentration of top 10 companies (regardless of the lines of business “Life” or “Not Life”) continues to grow and in 2021 will be about 73%.

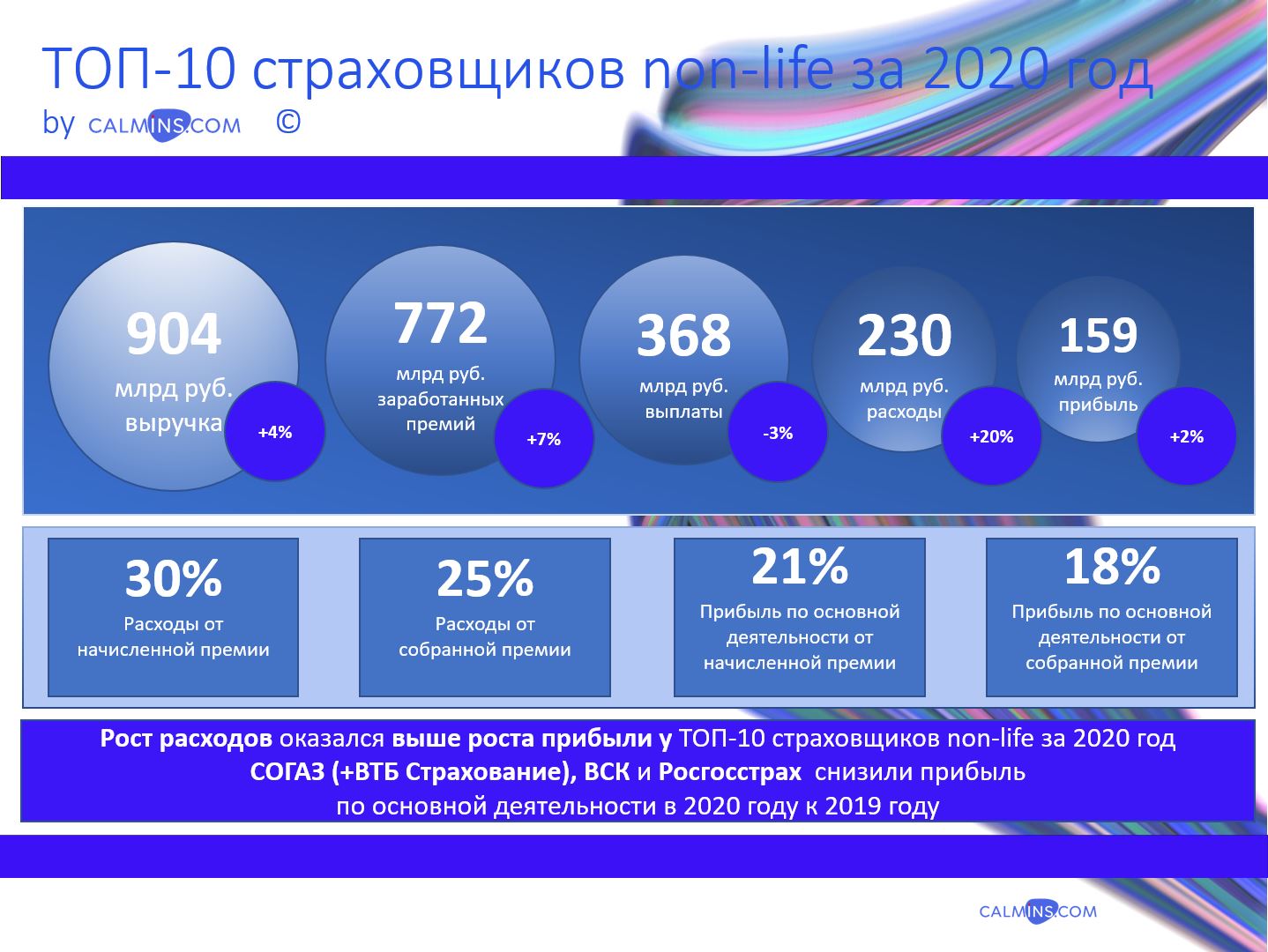

2. High profits of the insurance market in 2020

Despite the fact that the event belongs to 2020, we received the results only in 2021. The total profit of the insurance market in 2020 amounted to 247.5 billion rubles, which is slightly, but exceeded the results of 2019.

Profit growth was caused by an increase in return on investment activities due to the revaluation of currency assets, despite the decline in the result from insurance activities. In its reviews, we have already considered the financial achievements of the top 10 companies of “life” and “not life”. 10 Main Insurance Insurance Insurance Events 2021 – Expert Opinion.

High Profit has been associated with a decrease in frequency of consignments on auto insurance and DMS. However, 2021 showed itself on the other hand – the increase in the average payment and frequency of appeals, which will lead to a relative decline in the insurance market. Nevertheless, there is a chance that in absolute expression on the basis of the current year it will grow.

3. Exit from the Russian market of a number of insurers and the withdrawn of a license

For 9 months of 2021 9 organizations left Russian market (licenses were withdrawn):

- Far Eastern Railway Joint Stock Insurance Company “DalJASO”

- Limited Liability Company “Insurance Company” Siberian House of Insurance”

- Limited Liability Company Insurance Society “Geopolis”

- Limited Liability Company “BIN INSURANCE”

- Joint-Stock Company Insurance company “Prestizh-polis”

- Joint-Stock Company Insurance company “Renesance health”

- Non-commercial corporate organization Mutual insurance consumer society “Saklau”

Also, one of the “loud” events was a revocation of the license from a major insurer “ASKO insurance” on December 3, 2021, which was due to the violation of the minimum permissible value of the normative ratio of equity and adopted obligations.

Note that in 2020 the market suffered large losses – then licenses lost 27 insurance organizations:

- Limited Liability Company Medical Insurance Society “Panacea”

- Joint-Stock Company Insurance Company “Ingvar”

- Limited Liability Company “Retail and Corporate Insurance”

- Joint-Stock Company Insurance Company “Chuvashia-Honey”

- Limited liability company medical insurance company “Medica-Vostok”

- Limited Liability Company Kairos Insurance Company

- Joint Stock Company “Insurance group “UralSib”

- Joint Stock Company “Medical insurance organization “Nadezhda”

- Limited Liability Company “Transnational Insurance Company”

- Limited Liability Company Insurance Company Nadezhda

- Closed Joint Stock Company “General Insurance Joint Stock Company “Plato”

- Joint Stock Company “Insurance Group “Spasskiye Vorota-M”

- Closed Joint Stock Company “Success Insurance Company”

- Joint Stock Company “Insurance Company “Railway Insurance Fund”

- VTB Limited Liability Company Medical Insurance

- Limited Liability Company “Industrial and Trade Insurance Company”

- Limited Liability Company “Insurance Company “Surgutneftegaz”

- Limited Liability Company VERNA Insurance Company

- Limited Liability Company “National Insurance Group – Rosenergo”

- Limited Liability Company “Insurance Medical Company “UMMC-Medicine”

- Limited Liability Company ROSINCOR Reserve Insurance Company

- Limited Liability Company “Insurance Company “VITAL-Policy”

- Limited Liability Company “Bank Insurance Company”

- Joint Stock Company VTB Life Insurance

- Non-profit organization Mutual insurance society “People’s cash desks”

- Non-profit organization “Consumer Society for Mutual Insurance of Civil Liability of Developers”

- Limited Liability Company “Insurance Company “SERVISRESERVE”

We hope in the coming 2022 market will suffer less losses, and the company will maintain licenses with themselves.

4. Foreign insurers in Russia – the second advent

From July 1, 2021, a law on the possibility of working at the insurance market of Russia of branches of foreign insurers has entered into force. The changes were made to the Law of the Russian Federation “On the organization of the insurance in the Russian Federation” of 11/27/1992 N 4015-1. According to the law, a foreign branch provides a guarantee deposit on accounts in the Deposit Insurance Agency (DVI) in the amount of the authorized capital of Russian market participants, has admittance to almost all types of insurance, the Central Bank is subordinated to.

So far, there are companies with foreign participation that are already working in the Russian Federation: Allianz (100% share in JSC “Allianz” and LLC UK Alliance Life), Generali (about 40% in the company IPJC “Ingosstrakh” and subsidiary company LLC “Ingosstrah-life”), AXA (about 40% in the IC “RESO-Guarantee”), Societe Generale (Rosbank PJSC and Societe Generale Insurance LLC and Societe Generale Life Insurance LLC) и Raiffeisen Bank International (AO Raiffeisenbank and subsidiary IC OOO Raiffeisen Life”), Group PPF (bank “Home Credit” and LLC “PPF Life-Insurance”).

At the same time, Metlife, the Insurance portfolio of which was acquired by the Sovkombank Group, and Sovkombank Life and Sovkombank Insurance (AO) left the Russia’s insurance market.

At the beginning of the year, the situation with the group of RESO (the international insurer Generali was seriously interested in it) was actively discussed. It happened against the background of active sales of subsidiaries of the AXA insurance group in Europe and the world. Global Agency Insurer Generali was interested in SAO “RESO-Guarantia” as the first insurance company for insurance in Russia with a good financial result, and the fact that it recently paid dividends to its shareholders after a long expectation (compared to Ingosstrakh which is owned by Generali for about 40%). According to the market, negotiations moved away for 2022, but most likely, they will not end with anything.

Renaissance Insurance Company recently passed through the IPO and is now trading on the MOEX, so shareholders can also be presented by foreign investors, but we will consider this insurer separately.

5. IPO PJSC “Renaissance Insurance Group” – expectations and harsh reality

Recently, the company announced an IPO and successfully held it, after the sale of the share of the NPF “Blagosostoyanie” to the structures of Abramovich. The price of the primary placement of 120 rubles per share was announced, the maximum price was 125 rubles. However, after two months, Renaissance shares are traded on the MOEX at a price below 100 rubles per share. At the same time, Boris Yordan’s company announced the re-placement plans: SPO instead of an IPO in a year.

The Renaissance Insurance Group also includes its 100% subsidiary of Renaissance-Life LLC, which is engaged in life insurance. In general, the Group of Companies, according to the information on the insurer’s website, also includes Renaissance Health JSC and Digital Health Technologies, OOO, Medkorp LLC, Renclique LLC and some others. The insurer positions itself as an innovative Inshurtech Fintech company.

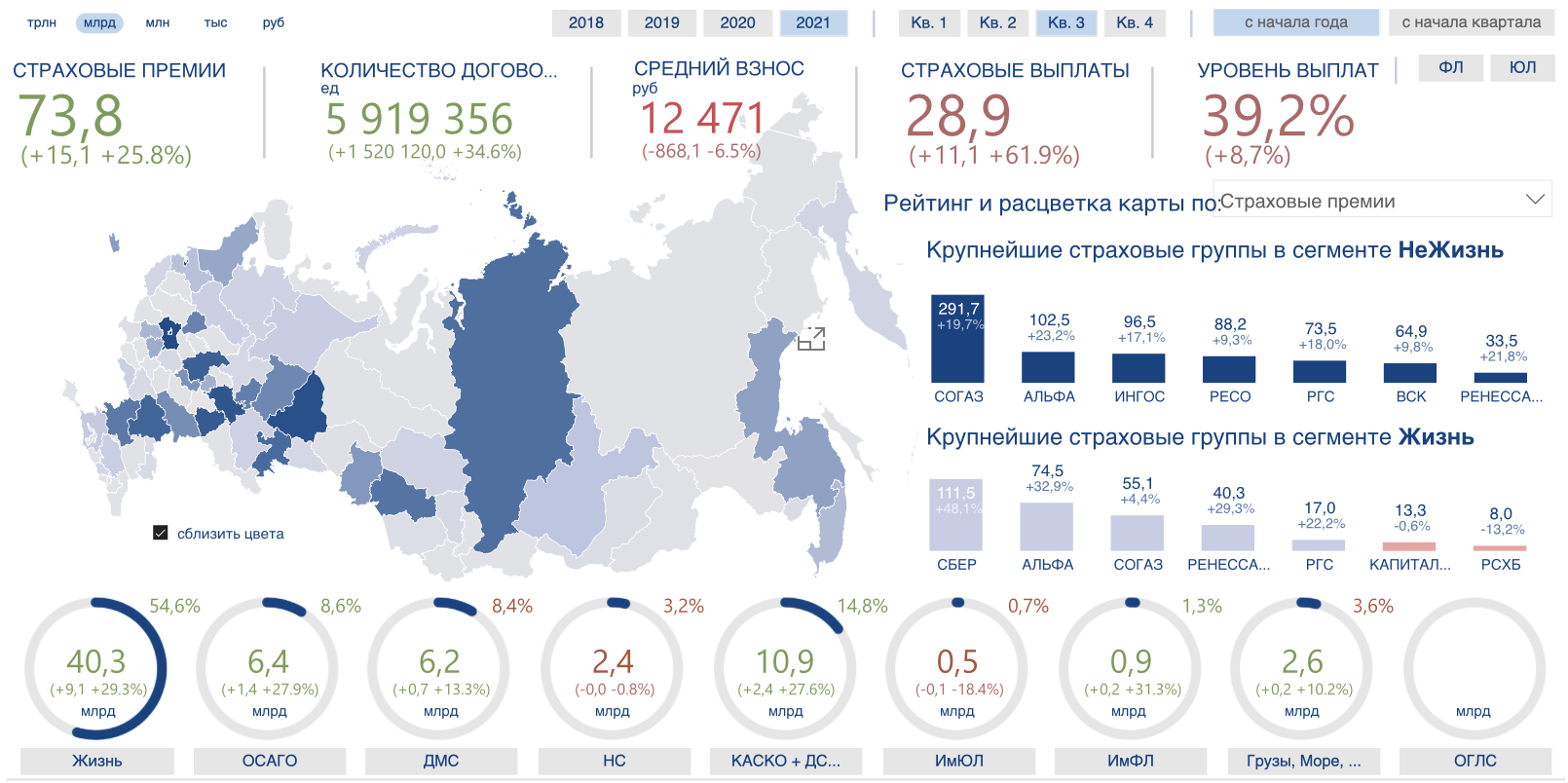

Info tables, developed by the expert of the insurance market by Maxim Chernov, according to the Central Bank of the Russian Federation.

The total fees of the Groups of 9 months of 2021 amounted to almost 74 billion rubles (growth above the market – plus 26%), the level of payments was about 40%, the total The share of life insurance in the group is more than 50%.

6. Rosgosstrakh – 100 years, or how to survive them

The oldest company in Russia Rosgosstrakh on October 6, 2021 passed 100 years old. Rosgosstrakh Group of Companies has branches and representative offices in all regions of our country, ranks 5th place in the insurance market for the first 9 months of 2021 and is included in the banking group the discovery owned by the Central Bank of the Russian Federation. The subsidiary of PJSC SK “Rosgosstrakh” LLC Rosgosstrakh-Life also ranks 5th place in Russia in the market for life insurance. For the last few months, the sale of Rosgosstrakh was repeatedly discussed, and among the possible applicants called the concern “Russium”, the structures of Gazprombank, VTB and SOGAZ, and even Generali. But judging by all, the negotiations were not over and Rosgosstrakh, along with the parent company Otkrytie will go to the IPO, as previously discussed. Wishing to buy the whole lot of the whole (banks of the group, the opening, insurance and retirement business) approximately for 1 trillion rubles, apparently, was not found. The likelihood that the opening will go along the way IPO indirectly says the consolidation of banking assets in recent months (a subsidiary of Trust and RGS-Bank).

The company submitted the requirements of the 710-P, but the new strike, apparently, they were seriously expected – the former subsidiary “Capital Life Insurance of Life” recited more than 12 billion rubles. However, nothing bad with customers will occur because the company is a state (actually belongs to the Bank of Russia), but questions on the effectiveness of the management remain …

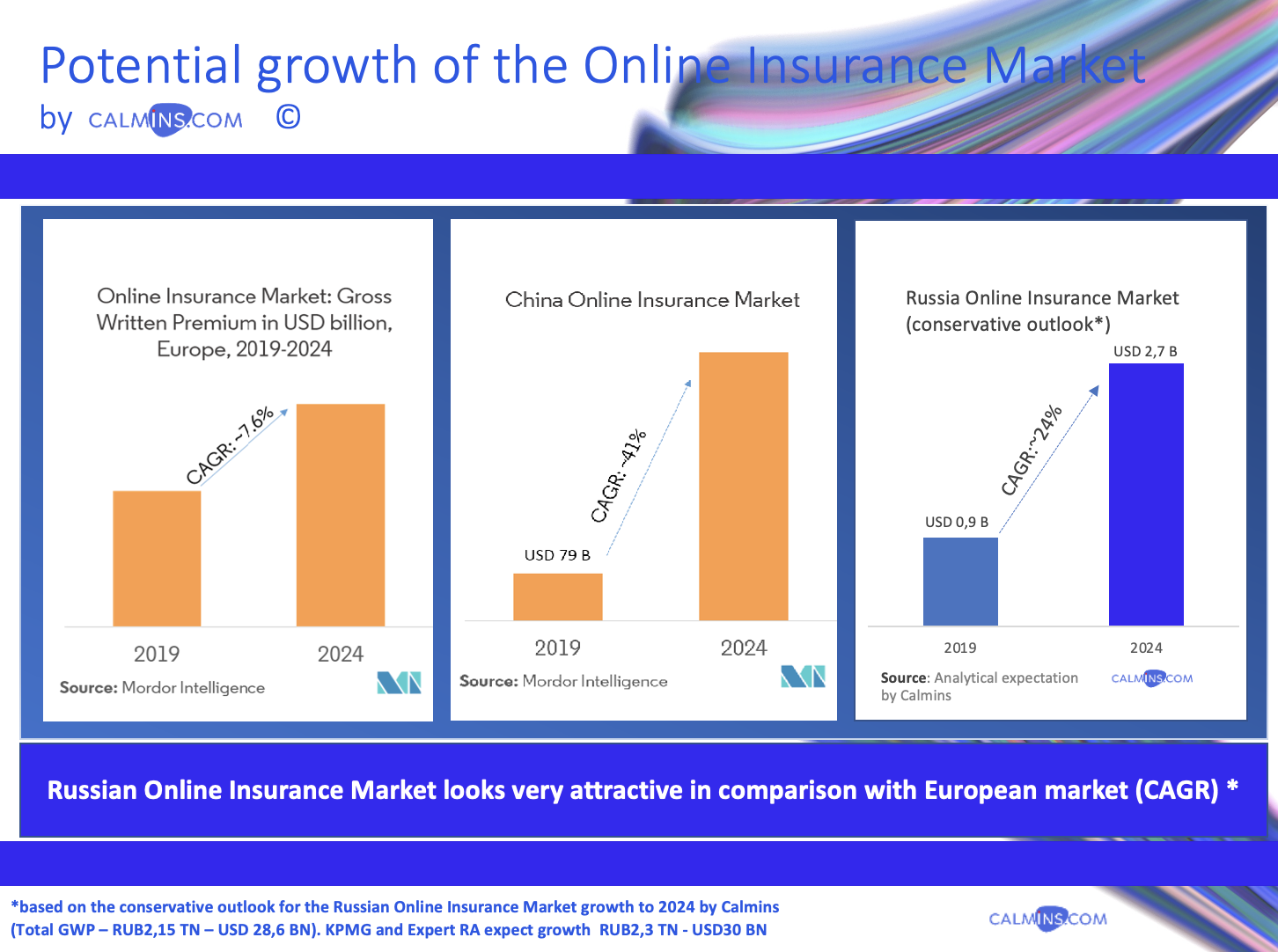

7. Growth of the Internet channel sales and waiting for the growth of the share up to 10% by 2024

The online insurance market is growing rapidly, however, while its share is insignificant – less than 5%. The main type is third party liability insurance. In general, the insurance market has high expectations on the scaling of the online segment in Russia to significant values.

Based on the research we conducted, the forecast growth of the Internet insurance market in the Russian Federation by 2024 will exceed 200 billion rubles, but with a favorable forecast may exceed even 0.5 trillion rubles.

In January 2022, we will prepare the updated data on this analysis and the report will be available at the Analytical Reports Store for your attention.

8. 710-P: Requirements for sustainability and solvency to insurers

Since November 2021, all insurance companies are required to revalue capital in accordance with Regulation No. 710-P. The provision requires the fulfillment of the solvency standards of insurance organizations in Russia, with the result that some insurers had to significantly increase the authorized capital of the company. This is due to the fact that thanks to the new method of calculating the assets that previously entered into the calculation of the organization’s own funds are now excluded from them.

9. Discussion of changes in the third party liability insurance: Growth of liability limits and expansion of the tariff corridor

In 2021, the third party liability insurance ” detached” from the technical inspection, the increase in limits for the payment of risks of life and health, as well as the harm of the property, and further expand the tariff corridor.

MOT Test AND third party liability insurance: Divorce and maiden name

In 2021, for car owners who use category cars in not for commercial purposes, finally canceled binding to pass the technical inspection. How it is wisely – the time will show, however, the car means device of heightened danger. And keep a car in a technically good condition – the obligation of the car owner. Moreover, recently the number of accidents has grown, where the main reason is indicated by the ” transport facility disrepair”. Nevertheless, it is discussed that the ” cavils” on the road from the traffic police will be minimal in the presence of a voluntary and diagnostic card. Mandatory inspection is expected only for taxis, buses and trucks, as well as for commercial vehicles.

Expansion of the tariff corridor

Over the past five years, the Bank of Russia has taken measures to liberalize tariffs for the third party liability insurance. In September 2020, the individualization of the tariff entered into force (it depends on the client profile, which made a fairly opaque process of calculating the cost of the policy of the insurer). In the current year, the coefficients on the third party liability insurance are somewhat changed.

However, the significant increase in the average contribution of the third party liability insurance has not happened – the growth of insurance prices amounted to about 1-2% for 9 months of this year.

However, it is already possible to say with confidence that for many conventionally “good” car owners the tariff for the mandatory auto insurance policy decreased, and for more risky and unprofitable – increased. In the first case, when calculating the cost of the third party liability insurance policy on marketers, it is enough to have enough to receive even benefits – up to 30 or more percent.

Nevertheless, an increase in the average price of the third party liability insurance certificates to continue, as new cars have increased in price and there is a shortage of component parts.

Increase the payment limit on the policy of the third party liability insurance and excluding amortization

For several years already has been discussed an increase in the limit of payments for civil accommodation for the harm of the life and health of third parties to 2 million rubles, and for harm to the property of third parties do not plan. Recently, this niche was held by the contracts of voluntary insurance of third party car insurance with franchise equal to limits on the third party liability insurance. However, not all insurers are ready to provide such protection to their customers, more often only with a fully comprehensive insurance.

Obviously, if this measure is implemented in 2022, this will lead to a significant tariff growth. According to our assessment, it will be at least 30%. With sufficiently high inflation in Russia and the overall increase in the cost of life, this can provoke a decrease in the number of insured and growth in sales of “left policies”, whose share is currently about 10%, and 10% of customers simply do not have the third party liability insurance certificates.

It is supposed to forbid insurance companies to take into account the wear and tear of a car damaged in an accident when calculating payments for repairs. Now insurance provides for the payment of compensation to car owners or the restoration of a damaged car. The Central Bank supports the gradual introduction of changes so as not to cause a sharp increase in the cost of the policy, since this will not be pleasant news for car owners.

The fourth initiative provides for mandatory inspections for taxis, buses and trucks, as well as for commercial vehicles.

10. Fighting for life: what is waiting for the life insurance market in 2022

In 2021, several directions were actively discussed:

- Introduction Questioning for customer qualifications that buy complex investment insurance products (investment life insurance , accumulative life insurance),

- Regulation of the credit insurance,

- Changes to the Directorate of the Central Bank of the Russian Federation 5055-y

- Appearance of the shared-equity life insurance on the market,

- Possible protection of savings (as in the case of deposits up to 1.4 million rubles) from the DIA in 2022

Questioning and qualifications of customer-investors

This questionnaire of a qualified investor unified insurers in 2021 independently, based on recommendations and requirements of the Bank of Russia. It was successfully implemented and made it possible to reduce the number of complaints on Misseling about 2 times.

Credit insurance

For credit insurance, the regulation was actively intervened by FAS, so that the consumer would have the opportunity to choose the insurer when receiving a consumer loan. Together with the Bank of Russia, it is planned to introduce strict requirements for the unification of the policy and conditions.

In 2021, the credit insurance market is the most rapidly growing. But it is important to note that the share of bank remuneration for this area usually reaches 90 and more%, and with a bank as a rule, 1-2 insurer works, which limits competition. When introducing a new approach, most likely, the loan insurance fee will fall, and loan rates have achieved real market values (since they will not shift and triggered by insurance). This will allow the market to become more transparent and competitive, but will lead to a decrease in the income of credit institutions.

Projects of change in the direction of the Bank of Russia 5055 (number changed to 5968-y)

At the beginning of 2022, we’ll devote this topic in several articles. A draft on amendments to the direction of the Central Bank of the Russian Federation of January 11, 2019 No. 5055-y “on the minimum standard requirements for the conditions and procedure for the implementation of voluntary life insurance with the condition of periodic insurance payments (rent, annuities) and (or) with the participation of the insured in the investment income of the insurer” and Appendix to Ordinance No. 5055-U.

And on December 22, 2021, the final (according to our assessment, third) version of the change appeared on the Bank of Russia’s website, which was expressed in a new Direction of 5968-y

Briefly the essence of the changes offered by the Bank of Russia, the following: The state plans to protect customers under contracts with the sum insured to 1.5 million rubles:

- Set the minimum payment of the risk of “survival” in the amount of at least the sum of all payments paid by the certificate;

- Payment at risk “Death for any reason” is proposed to establish in the amount of at least the amount of paid contributions under the contract with a one-time payment, or multiplied by a certain coefficient (depending on the age is insured and the term of the insurance) the sum of payments during the 1st year of the agreement in case of staggered payments;

- When terminating the contract, the period of full refund of paid funds is 30 calendar days, or before paying the third regular contribution;

- Circumstances that are essential to determine the probability of occurrence of insurance risk are limited by socially significant diseases in accordance with the list approved by the Decree of the Government of the Russian Federation, and not the “Declaration” of the Insured, which was developed by each country;

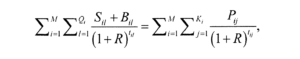

- There was a mandatory formula for calculating the profitability under contracts, on which the obligations are terminated by the fulfilment.

It should be noted that on the one hand, this is the right step towards the consumer and an unprotected segment for small accumulative insurance policies (investment and accumulative life insurance) with the sum insured to 1.5 million rubles. However, it is heavy enough for the market in terms of implementation, especially in assessing the risk and tariff, and will also lead to an increase in the average check under the contract, where the possibilities for maneuver in insurance companies will be greater.

In detail on this issue in the article “Fighting for Life”: what is waiting for the accumulative insurance market in 2022 the Copyright Categories.

Equity life insurance

Equity life insurance should come to a change to the investment insurance of life, however, the market does not yet believe that this species will occupy a significant share in 2022, and possibly in 2023. A new approach should reduce misstate. According to these treaties, capital is not protected, they must become more transparent, unlike the sorry, but to target only for qualified investors who realize and understand where they invest their savings, carrying risks, but also the possibility of obtaining more.

The option of its implementation is discussed through the issuance of one license for both management companies and insurers.

Protection of accumulations in life in the Deposit Insurance Agency

The process of discussion with the Bank of Russia Insurers is in full swing, and according to information from the market, there is a high probability of realizing the protection of life insurance accumulations in the amount of up to 1.4 million rubles, as in the case of bank deposits and accounts, next year. Moreover, it is discussed that the percentage of deductions by the insurers in the ABS for insurance of savings will be less than for credit institutions.

According to experts, such protection will allow to increase the public confidence in life insurance products and will allow you to safely invest our savings in long-term instruments.

Summary

It should be noted that for the insurance market as a whole, 2021 was quite positive and promising. In 2022, the insurers of the “Life” segment will have to “compete for life,” but there will be some kind of decision. The online sales market will actively develop, including at the expense of major banking insurance groups.

With the tough unification of credit and mortgage insurance, the market volume may decrease, since the competition will increase and reduce banking commissions, however, the transparency of the certificate, the availability of insurance and the competitive environment will increase.

Also, the year may be remembered as the beginning of the era of Insuring, about which we told in more detail in the article Mango Inshuring – the insurance market comes out of darkness and a very new post of mafin with mango, but this is a completely different story…

Happy New Year! All health and positive, insurance market – growth and new ideas, and for customers – consumers of insurance services – customer oriented and necessary products at an affordable price!

Actual and Fresh data, analytics and forecasts of the Russian market in the information and analytical resource of Calmins.com!

An article approved by an expert of the insurance market Denis Lebedev

Calmins.com ©