How to choose an insurance certificate from oncology online?

February 4 is a World Cancer Day. This topic does not lose its relevance and now. The risk of cancer and serious critical diseases at a young age is relatively small, although largely varies depending on the predisposition, activity, area of residence and type of pathology itself. However, after 40-50 years, the risks to become sick or other serious pathology, especially in the case of a certain heredity, increase significantly.

According to data published on the site of the main oncologist of the Ministry of Health of Russia, in 2020, almost 4 million citizens were registered with Russian oncologic dispensary. At the same time, in general, during that year more than half a million new cases of cancer were revealed. Mortality statistics are also extremely disappointing – in Russia in 2020 almost 300 thousand oncological patients took away from life. Such a situation is observed throughout the world – cancer remains one of the main causes of deaths. Nowadays, cancer can already be cured despite the fact that it is still a rather complicated and long-term process. To increase the likelihood of successful cure, it is necessary to diagnose the disease at an early stage – receiving timely medical care will allow you to save your life.

Oncopathology treatment is quite expensive, but in most cases it is covered at the expense of the funds of the compulsory medical insurance fund, also the diagnosis of cancer is included. Citizens older than 40 years can be held oncoscrining annually, the younger population – when their age is multiple three.

The main problem of treating oncopathology is related to the fact that it is not always possible to reveal it quickly and in time and respond quickly, organizing proper and timely treatment. Unfortunately, the compulsory medical insurance is not always able to provide such operational treatment due to the limited number of quotas and large queues. Such a situation is often necessary for the development of cancer and other severe diseases. Therefore, large finances may be required for operational treatment in a short time.

The second problem point is not for all diseases, it is possible to organize treatment at the regional level. The key to success is the correct diagnosis and the appointment of the relevant modern treatment. In this case, it may be necessary in the clinics of the level of Moscow and even abroad. Such treatment is a high-tech and very expensive, and exceeds the possibility of compulsory medical insurance. Depending on the form and stage of the disease, as well as the general state of the person, the amount of financial costs can be from half a million rubles to hundreds of thousands of dollars.

Oncology insurance – an effective mechanism for protection against cancer and serious diseases

In recent years, programs for insurance against critical diseases and oncology, which are offered by various insurance companies, were widespread, which are proposed by various insurance companies, and the growth in demand is directly due to their high relevance.

In the column “test purchase” we have repeatedly considered various cancer insurance programs that are available for buying online on the websites of companies. In this review, we will talk exactly about such insurance online products. We will focus on the proposals that are VHI services (diagnosis and treatment). Products implying a one-time monetary pay in the event of the occurrence of the disease, we will not consider this article.

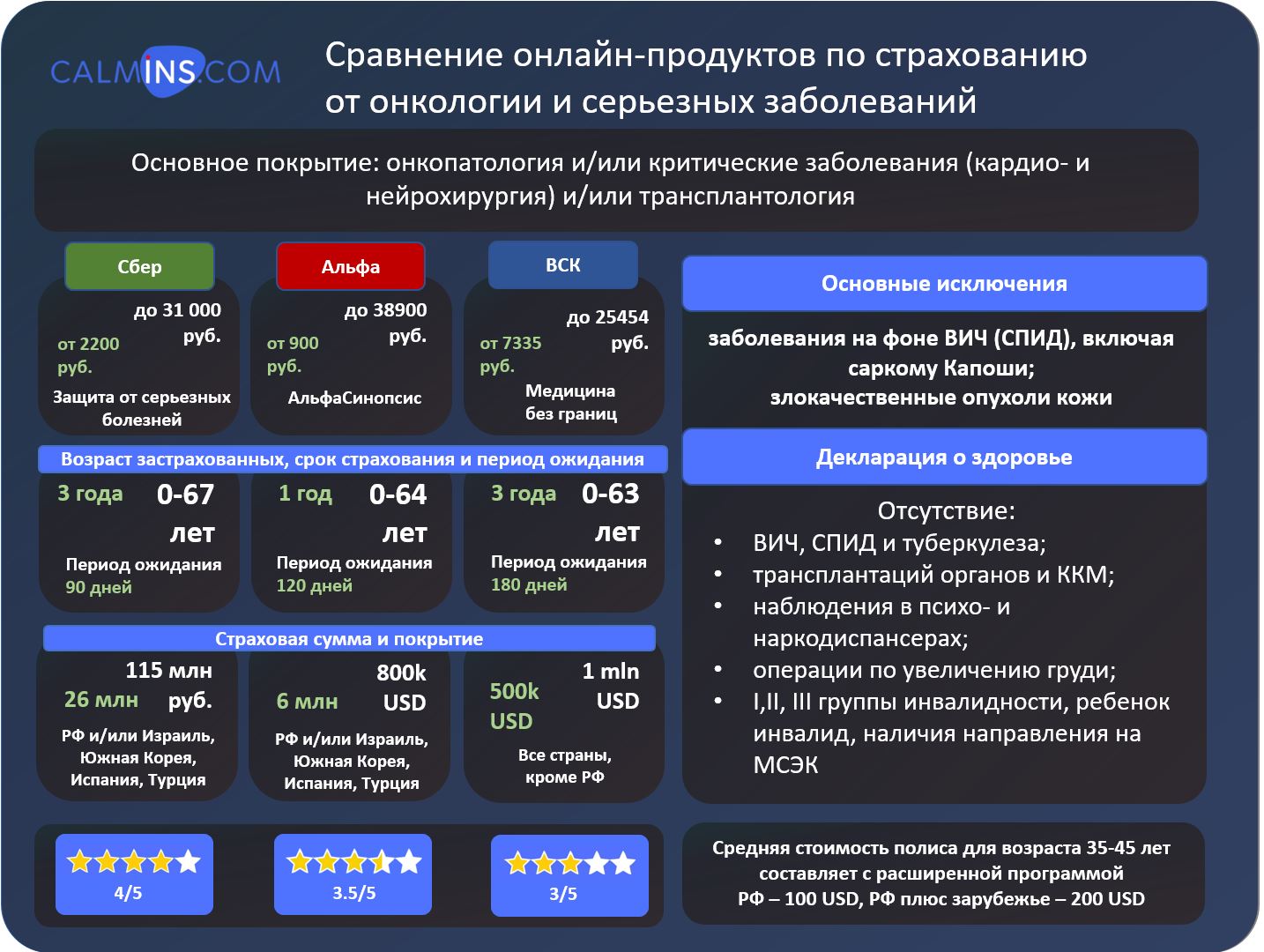

We have chosen for examination 3 well-known insurance companies with similar programs (with a package of services for the VHI, not with a fixed amount in case of a disease):

- AlfaInsurance JSC with insurance program “AlfaSinopsis”

- “VSK” JSIC with “Medicine without borders”

- Sberbank Insurance LLC with “Protection against serious diseases”

During our research project we planned additionally take to programs for comparing “Medicine without borders” from LLC Renaissance Life and “Health Without Borders” from a IPJSC “Reso-Guarantee”, however, for 2021 both companies did not make a step towards the client and did not provide the possibility to buy it online. These products you can buy only offline through insurance agents or through an insurance company specialist.

AlfaInsurance JSC with insurance program “AlfaSinopsis”

Certificate is available online. We have repeatedly told about the advantages and disadvantages of the product in our articles in the column test purchase. I will not disassemble it in details; let’s stop at the important points. Insurance covers risks associated with the formulation of primary diagnosis, the organization of treatment for oncological diseases (including cancer at an early stage – in situ), as well as neurosurgical and cardiac surgery pathology.

In each program included: outpatient and stationary treatment, verification of the diagnosis and organization of routing, flight, accommodation, accompaniment. For each position identified insurance sums limits.

The period of insurance contract entry (waiting period) is quite large – 120 days. The age of the insured – from birth to 64 years at the time of the contract.

Treaty term – 1 year, lump sum payment.

The territory where treatment is available depends on the programs: Russia or Israel, South Korea, Spain.

The cost of insurance depends on the insurance program, the age of the insured and the place of treatment (Russia or abroad). The price of the certificate is starting from 900 rubles for children up to 38 900 rubles for the customer 48-67 years. Insurance amount with a maximum insurance program is 800 thousand USD.

Below is a comparative table of insurance programs within the Alpha Synopsis product:

Exceptions from the coating and the declaration of insured similar to similar documents of other insurers. On the site we could not find a project of the insurance certificate and a memo for the insured.

Filing out of the online certificate from AlfaInsurance JSC – insurance program “AlfaSinopsis”

For filing out, it is enough to go to the site, specify the date of birth and choose the insurance program. Then you need to read all the terms of insurance and the declaration (located below) and begin the design process. Click the “Establish” button. Make a phone and email in the mold (the insurance policy and rule will come to it). Then go and fill in the passport details. The process itself took a few minutes. Polis comes to mail. Unfortunately, it was not possible to find a list of clinics in which treatment is carried out.

We made a calculation for the client – a man of 44 years, which confirms the declaration. The price of the certificate on an extended insurance program, including the risks of oncology and other critical diseases (indicated in the program), amounted to 4900 rubles per year. The price is relatively low. For a boy of 10 years, extended protection in a similar program costs 1900 rubles per year, which is also a fairly low price, taking into account the large risk set.

An important addition: treatment is carried out in the clinics of the Russian Federation, even the nursing home care includes, but for a small amount – 100,000 rubles, and 300,000 rubles for implantation. The option of bone marrow transplantation is missing in the insurance program.

Brief results and expert assessment of “AlfaSinopsis” from Calmins.com

The certificate “AlfaSinopsis” has a fairly broad insurance coverage (up to 800 thousand USD), available options for the price (from 1,300 to 38 thousand rubles), but the age of the insured is limited to 64 years and is enabled quite a long time ago (120 days), The most inexpensive of similar proposals, especially for the insurance of children and treatment in Russia. However, insurance premiums are high enough for older people, and since 45 years old.

Certificate allows you to get a treatment both in Russia and abroad (in Israel, South Korea and Spain). The program covers in situ cancer. The declaration is quite typical, but there are no hard restrictions on weight, heredity (the occurrence of cancer in relatives only after 60 years). The programs separately allocated sister care at home (from 100 thousand rubles to 10 thousand USD), prosthetics and implantation (from 300 thousand rubles to 15 thousand USD).

The product is simply issued online (filling takes a few minutes), there are information on the conditions of each program (for example, for the treatment program abroad) and health declaration.

According to Calmins.com, the product receives an estimate of 3.5/5, taking into account the high availability at a price for people up to 45 years.

The reference is available for quality certificate with product evaluation from experts Calmins.com.

The estimate of 4/5 requires an expansion of the age of insured, expanding the list of countries for treatment abroad, the inclusion of organ transplantation, increase the age (from 45 to 48-50 years) for the most expensive category of policies, the decrease in In more detail we will be able to answer you by email info@calmins.com.

“VSK” JSIC with “Medicine without borders”

The VSK program “Medicine without Borders” covers the risks associated with the formulation of primary diagnosis, the treatment on oncological diseases (including cancer at an early stage), as well as neurosurgical and cardiac surgery, but depends on the chosen program. Both programs allow you to organize treatment of critical diseases and oncology only abroad.

In each program included: outpatient and stationary treatment, verification of the diagnosis and the organization of routing, flight, accommodation, accompaniment, as well as bone marrow transplantation. Each of the positions identified the limits of insurance sums.

Flight and accommodation is limited to 1,000 USD (each) per year in the basic version.

The term of the contract is 3 years, the annual payment of contributions.

The period of insurance of the insurance contract (waiting period) is 180 days.

The age of the insured should not exceed 63 at the time of purchase of the new certificate and 85 years in the event of an extension of the policy acquired earlier.

Exceptions from the coverage and the declaration of the insured are very similar to similar documents of other insurance companies. On the site we could not find a project of the insurance certificate and a memo for the insured.

Filling out of the product online takes a few minutes and the passport data of the insured and the insured, as in other insurers, is required. There are no difficulties in the filling out of the contract as well.

Two insurance programs, the main difference between which is to limit the sum insured and the latitude of the risks covered (only oncology – up to 500 thousand EUR, or onco with cardio and neurosurgical pathology – up to 1 million EUR.

Registration of the online certificate from – “Medicine without Borders”

for registration is enough to go to the site, click the “buy online” button, put a date of birth. There is a calculation on both programs. Press – select the program, make your passport details, telephone and email (the insurance policy and rule will come to it). Then get acquainted with the general conditions of insurance, insurance program, confirm that they agree with the items on the Health Declaration and pay. The process itself took a few minutes.

We made a calculation for the client – a man of 44 years, which confirms the declaration. The price of the policy on the minimum insurance program, including the risks of only oncology, but with treatment abroad (without payment of unconditional franchise – treatment abroad in Spain, Israel, South Korea, Turkey, Czech Republic, Croatia, Taiwan For a boy of 10 years, extended protection for a similar program costs 7335 rubles per year (about 100 USD), which is also quite acceptable, taking into account the large risk set.

An important addition: treatment in other countries – only with an unconditional franchise from 2000 to 5000 EUR. Assistance is carried out by Further, represented in more than 30 countries of the world. In Russia, Further provides the organization of service for insured persons who have serious diseases.

Brief results and expert assessment of the Cell product from Calmins.com

The certificate of “medicine without borders” has a fairly broad insurance coverage (up to 1 million EUR), the price of the product begins from 7335 rubles (~ 100 USD) to the maximum option for the price (up to 25454 rubles), but the age of the insured 63 is limited

Certificate allows you to get treatment only abroad (the whole world, except Russia and the USA). The declaration is quite typical, includes more than 4, heredity (the occurrence of cancer in relatives after 50 years).

The treatment is carried out without a franchise in Spain, Israel, South Korea, Turkey, the Czech Republic, Croatia, Taiwan, Malaysia, Belarus. In the United States and Switzerland, the unconditional franchise 5000 EUR, and in other countries – 2000 EUR.

The product is simply issued online (filling takes a few minutes), there is information on the site for the conditions of each program and the health declaration. The exclusion of Russia for the treatment of critical diseases and cancer is a controversial question, since most of the population would prefer to get help here.

According to Calmins.com, the product receives a 3/5 rating.

The reference is available for a product quality certificate with an assessment from Calmins.com experts.

To estimate 4/5, it is necessary to expand the range by age insured, the inclusion of options with treatment in Russia, the inclusion of organ transplantation, an increase in age (from 45 to 48-50 years) for the most expensive category of policies, reduction of the number of limited In more detail we will be able to answer you by email info@calmins.com.

Sberbank Insurance LLC with “Protection against serious diseases”

Most recently, the company SberInsurance (Sberbank Insurance LLC LLC) announced the launch of a new product – “Protection against serious diseases”. The insurance certificate on protection against critical diseases is available immediately on several sites: on the site of Sberbank and SberInsurance.

Key features of the product from savings

Insurance covers risks associated with the formulation of primary diagnosis and the organization of treatment on cancer (including cancer at an early stage – in situ up to 425 thousand rubles), as well as risks of need for neurosurgical and cardio. We note an important feature of this product: all treatment programs (in Russia and abroad) include bone marrow transplant, which is an important competitive advantage of this certificate.

Each program includes: medical navigation, outpatient polyclinic and stationary treatment, verification of the diagnosis and organization of routing, flight, accommodation, accompaniment. For each of the positions, limits are determined.

The period of insurance contract (waiting period) is relatively small – 90 days, while the insurance company will assist with medical advice from the first day of the policy, and if necessary, it will help with routing on CHI, even if the client just wants to go through.

The age of the insured – from birth to 67 years at the time of the conclusion of the contract. This is a fairly wide range.

Insurance certificate –three years with annual payment of a fee, so the insured can expect that the cost of the certificate will not grow for three years. It is also convenient for persons of 67 years, since such clients will be insured for three more years.

The territory where treatment is available depends on the insurance program: the whole of the Russian Federation or the Russian Federation and foreign countries: Israel, South Korea, Spain, Turkey.

The cost of insurance depends on the insurance program, the age of the insured and included clinics. The price of the certificate varies from 2,200 rubles per year for children up to 31,000 rubles a year for a customer 48-67 years old with a maximum insurance program with insurance amounts 20 million rubles – 85 million rubles.

All necessary documents on the program are available on the site: check list of the insured, rules of the insurance, the insurance certificate project, and even a list of all clinics. The company is maximally transparent and available provides information to its customers.

Exceptions from insurance coverage and Health Declaration

Clients are accepted for insurance, which are conditionally healthy and not having pathologies that are included in the insurance coverage of the policy that they confirm their consent to the Health Declaration. The main of them are standard: it is HIV, AIDS, tuberculosis, narcotic dependence, serious mental disorders, already available critical diseases of cardiovascular, nervous, digestive systems, oncology, systemic diseases, transplantation of the organs in medical history of a patient. The client at the time of the conclusion of the contract should not be the above states, as well as the client should not have a group of disability, and close blood relatives should not have been sick with cancer up to 60 years. Also an interesting point is the lack of earlier surgery of breast augmentation.

A detailed list of exceptions is available in the insurance rules and paragraph 3.1.1 and 3.1.3 of the insurance policy.

Amendments and termination of the insurance contract

During the first 14 days, the insurance contract may be terminated with a complete return of the contribution. In the event of termination after the specified period, the payment of the remaining amount is made by the formula specified in the insurance rules. To terminate, it is enough to fill out a statement, which is also present in the public access, and send the appropriate insurer documents. To make changes to the insurance certificate, you must fill out the application and send the insurer by attaching everything you need.

Execution of the certificate online from the Sber – “Protection against Serious Diseases”

For filling in, it is enough to go to the site, click the “buy online” button, select the program, enter your passport details, check everything, confirm and pay. The process of decoration has taken a couple of minutes.

To quickly fill out the data on the client, we used the Sber ID. It was necessary to independently fill out the address of the residence, the Inn (you can not specify), enter the email address to obtain an electronic oncopoly and payment receipt (the phone also loaded from the Sberle ID), put a check mark that the insured is the main. On the Confirmation tab, you need to check all the data again, confirm that you are not a public person, and agree with the Declaration of Health.

We made a calculation for the client – a man of 44 years, which confirms the declaration. The price of the policy on an extended insurance program, which includes maximum risks, but with treatment in Russia, amounted to 6,300 rubles per year. This is a fairly good price, in our opinion, is less than 100 USD. For a boy of 10 years, extended protection for a similar program costs 3300 rubles per year, which is also quite acceptable, taking into account the large risk set.

An important addition: if it is impossible to organize treatment on a product in the Russian Federation for 4 weeks, the savings is organized by treatment abroad. In our practice, we have not previously met such expansion in insurance programs on cancer. Within 1 minute, even before payment, the postman was sent to the post-mail, which is also available on the site, insurance policy and an insurance certificate with detailed information.

Brief results and expert assessment of the product from Calmins.com

The product has a good potential for customer recognition. The certificate “Protection against serious diseases” has a broad insurance coverage (up to 115 million rubles), available options for the price (from 2 thousand to 31 thousand rubles per year). Bone marrow transplant services are included in each policy, the program covers oncology in situ. Policy allows you to get a treatment as in Russia in leading clinics (including 14 clinics of Moscow) and abroad in Israel, South Korea, Turkey and Spain, including the policy of the flight, obtaining a visa for the patient and one Also according to the insurance rules, if treatment in these countries is impossible, it will be organized in the others not specified in the contract.

The product is available for children and older generation (up to 67-69 years). The contract has a fixed tariff at once for three years, in case of non-payment on the period of the next contribution, the insurer is actually responsible for another 120 days. The declaration is quite typical, but there are no hard restrictions on weight, heredity (the occurrence of cancer in relatives only after 60 years). Polis is very simple to be made online, the site has all the necessary information in full. According to Calmins.com, the product deservedly receives 4/5 rating.

According to the link for download, a product quality certificate is available with the evaluation of Calmins.com experts. For 5/5 estimate, in our opinion, it is necessary to include cash payments in the primary diagnosis of the disease, add Germany to a list of available foreign countries, increase the range of clients by age, reduce the number of exceptions in the policy and restrictions In more detail we will be able to answer you by email info@calmins.com.

Brief research results

According to the results of our analysis, it can be said that the most interesting, accessible and with a good risk set looks like a policy from critical diseases from the Sale. Among the subjects, he turned out to be the most interesting and promising, apparently, the team of productologists well worked, some disadvantages in the products of competitors took into account. At quite a reasonable price and ease in the design of the Certificate from Sberbank, it offers treatment both in Russia and abroad, with a reasonable period of waiting, and is 3 years, which, in our opinion, is very convenient. It is important to note that complex and high-precision methods of medicine and treat diseases are actively developing, and with them and insurance. The success of the treatment of oncology in many cases depends on the rate of assistance and on the accuracy of diagnosis, and these factors work for you when leading clinics and insurance company cooperate within the framework of the oncopolis.

I would like to note the positive for the market factor – onco insurance and insurance against critical diseases are increasingly becoming part of the basic package on the VHI of employees in many companies. Great and the fact that many insurance companies are trying to offer high-quality insurance products in the sales channel without direct human communication – for online purchase. As we can see, SberInsurance, AlfaInsurance and VSK are already good to a new stage prepared, unlike the reso-guarantee and the Renaissance. We are confident that this type of products from critical diseases will be finalized; the restrictions will decrease and expand the coating to gradually make the most customer-oriented products.

Actual expert assessment and analysis of insurance products on the information and analytical resource of Calmins.com – a deliberate insurance!

An article approved by an expert of the insurance market Denis Lebedev

Calmins.com ©