Profit of insurance companies “Life” in 2020 – the fight against pandemic

In our previous review, we discussed the top 10 companies of the “non-life” segment and their financial results in 2020. Today we will look at the key indicators of the top 10 companies licensed for life insurance, relying on the data from their financial statements of 2020.

As we previously reported in the market analysis, the volume of the collected premiums of the life insurance companies increased by 3% (+14.69 billion rubles) and reached 457.40 billion rubles, and payments increased by 49% (+71 billion rubles) and amounted to 214.98 mn roubles.

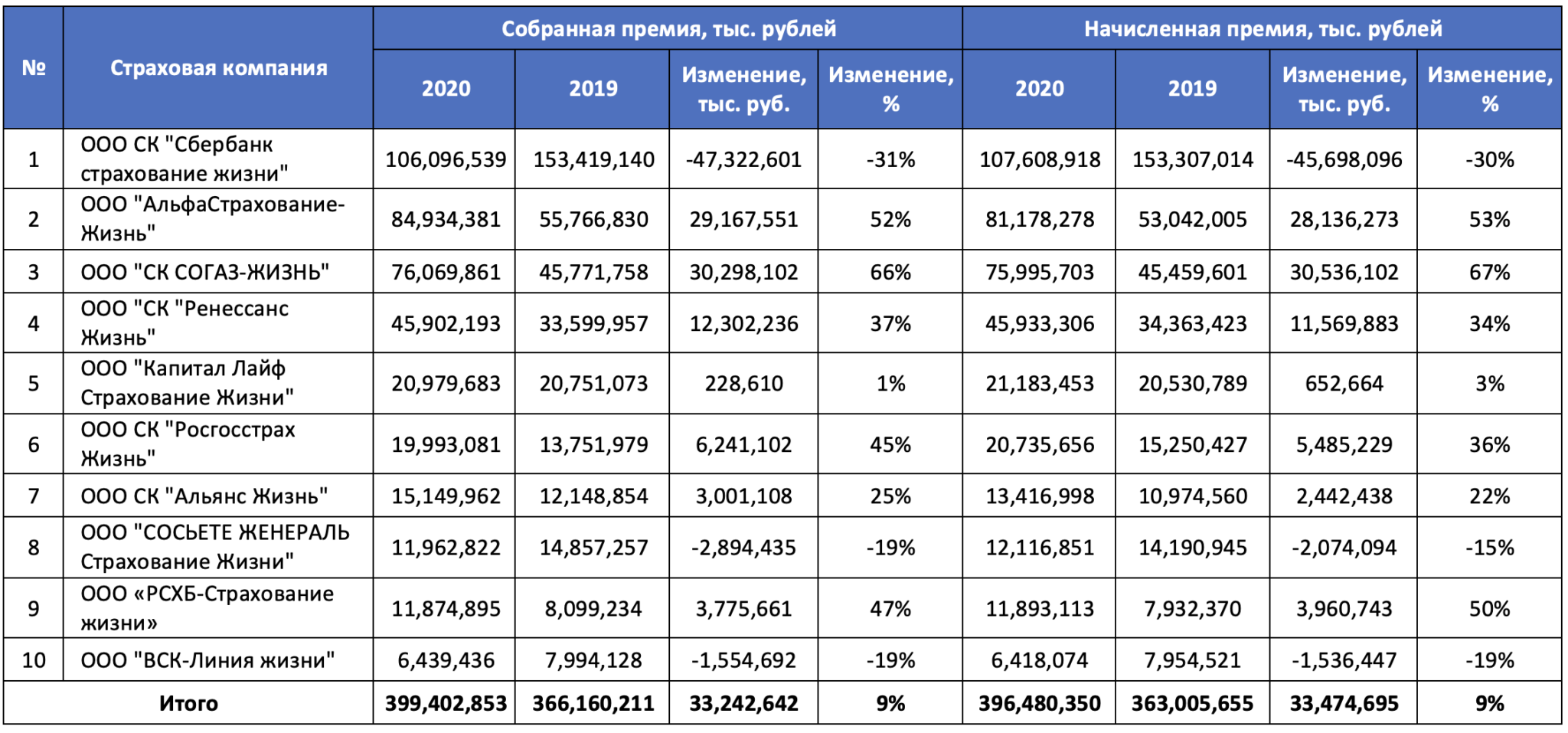

Premiums of top 10 Insurance Life Companies in 2020 and 2019

The table below provides information on accrued and collected awards of the top 10 companies.

The growth in collected awards by 66% and accrued premiums by 67% of the company IC SOGAZ-Life in 2020 was due to the acquisition of the company VTB Life Insurance Company. The company completed liquidation procedures in May 2021, but we were unable to find the reporting data of VTB Life Insurance JSC in open access, so this article does not take into account the merger of insurance portfolios of these two companies.

The volume of accrued premiums Top 10 Insurers grew by 9% (33.47 billion rubles) and amounted to 396.48 billion rubles. The amounts of accrued and collected premiums are approximately equal (the discrepancy is less than 1%), and the growth for 2019 is the same – 9%.

It should be noted here that in addition to life insurance, insurers also implement such products as VMI, insurance against accidents and disease.

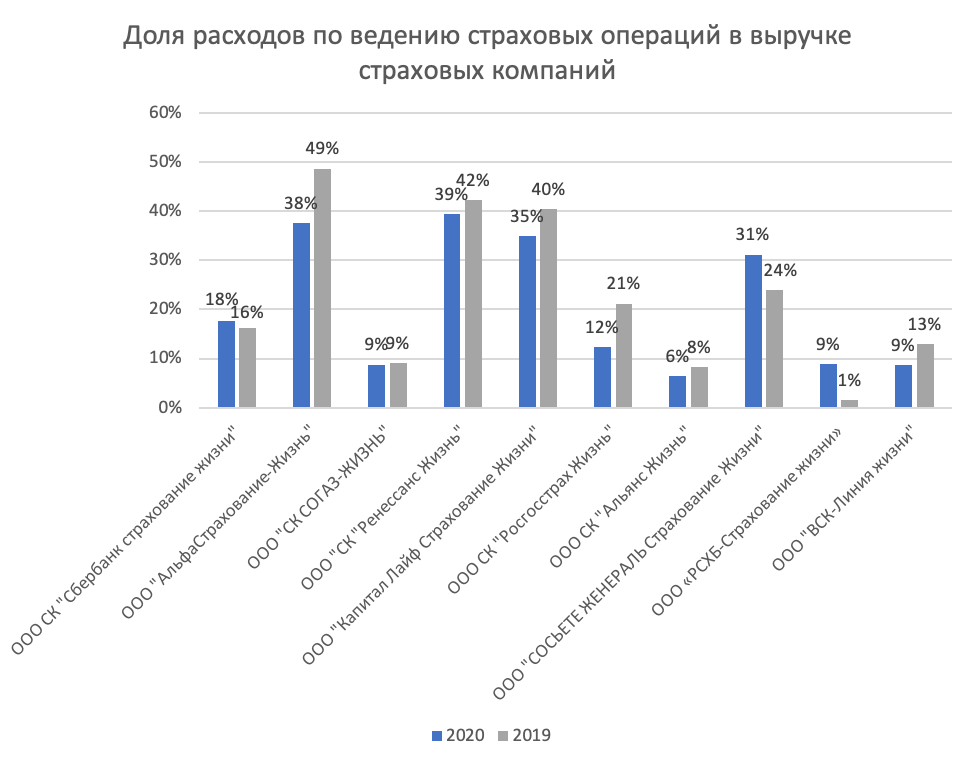

Expenses of insurance companies “Life” in 2020 and 2019

The table below provides information on the payments by insurance companies, as well as expenses for insurance operations. The life insurance companies included losses include both insurance claims that occurred during the period of action of the Treaty and paying at risk of survival, which includes a share in the company’s investment income.

In total, these two largest expenditure headings of companies accounted for 272.68 billion rubles and 202.08 billion rubles in 2020 and 2019, respectively, which was approximately 68% in 2020 and 55% in 2019.

The main part of the expenditure of insurance operations is commission on remuneration. As can be seen from the diagrams above, the share of expenses for conducting insurance operations in the revenue of insurance companies is heterogeneous from company to company. This range is due to different sales channels:

- banks included in the group;

- partner banks;

- agency networks;

- Internet and sale.

Insurance companies can combine one or more sales channels, and maybe all at once. Companies that come with banks in one financial group can pay them high commissions for their contributions, for a more even distribution of profits within the group.

The greatest share of the RVD in the revenue was marked at the following companies:

- LLC “SK Renaissance Life” (39% in 2020 and 42% in 2019);

- Alfa insurance Life LLC (38% in 2020 and 49% in 2019);

- LLC “CAPITAL LIF Life insurance” (35% of 2020 and 40% in 2019);

- Societe Generale Life Insurance (31% of 2020 and 24% in 2019).

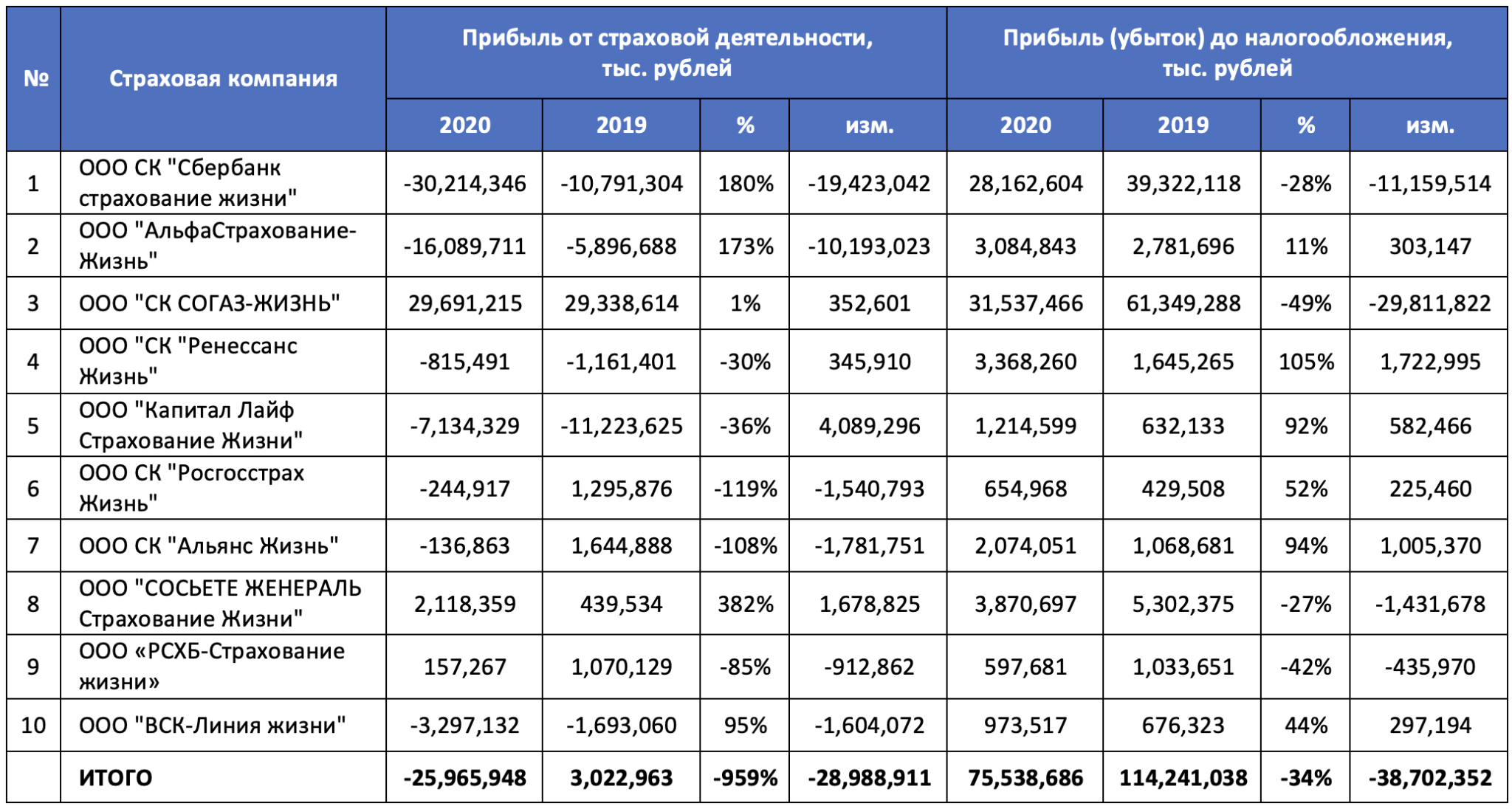

The dynamics of insurance companies’ profits

The table below shows the information on the profits of the top 10 insurance companies for 2020 and 2019.

After a profitable 2019, insurers suffered losses from insurance activities in the amount of almost 26 billion rubles in 2020.

The profits of insurance companies that have a license to carry out life insurance differs from the structure of the “non-life” segment of the sector. The first makes a profit due to investment of funds received from the Insured, as they cannot pay less than the premiums have collected for previous periods, since there is a risk component, as well as policies (accumulative life insurance), a guaranteed profitability is provided. The profit of insurers from insurance activity is explained by the fact that many major Insurance companies received a license to carry out voluntary life insurance less than 5 years ago, which is less than the minimum term of entering one of the main products – accumulative life insurance. The non-Life segment receives the main part of its profit due to effective underwriting – the collected premiums must exceed the amount of payments and expenses. Also, the funds received “non-life” are investing in conservative financial instruments, due to which profit from investment activities is formed.

The table below provides information on profits from investment activities Top 10 insurers.

| No. | Insurance company | Profit from investment activities, thousand rubles | |||

| 2020 | 2019 | % | change | ||

| 1 | LLC Insurance Company “Sberbank life insurance” | 61,037,300 | 52,193,260 | 17% | 8,844,040 |

| 2 | LLC “AlfaInsuranceLife” | 20,336,032 | 9,961,789 | 104% | 10,374,243 |

| 3 | LLC Insurance Company “SOGAZ – Life” | 26,659,525 | 6,781,502 | 293% | 19,878,023 |

| 4 | LLC Insurance Company “Renaissance life” | 6,145,436 | 4,553,588 | 35% | 1,591,848 |

| 5 | LLC “Capital life insurance” | 9,950,850 | 12,913,795 | -23% | -2,962,945 |

| 6 | LLC Insurance Company “Rossgosstrakh life” | 2,391,798 | 225,164 | 962% | 2,166,634 |

| 7 | LLC Insurance Company “Alliance Life” | 3,561,190 | 527,829 | 575% | 3,033,361 |

| 8 | LLC “Societe Generale Life Insurance” | 2,524,020 | 1,620,139 | 56% | 903,881 |

| 9 | LLC “RSHB-Life Insurance” | 914,910 | 327,637 | 179% | 587,273 |

| 10 | LLC “VSK life line” | 4,598,316 | 2,755,576 | 67% | 1,842,740 |

| TOTAL | 138,119,377 | 91,860,279 | 50% | 46,25 | |

During the year, the profit of insurance companies from investment activity increased by 50%, reaching 138 billion rubles. The Central Bank of the Russian Federation notes that such a dynamic is due to the main re-valuation of currency assets.

Profit from investment activity depends on the amount of insurance reserves and the effectiveness of this activity by the insurer. As we mentioned above, for customers, insurance companies of cumulative insurance programs usually offer guaranteed profitability and optionally additional income based on the results of the company’s investment unit for the year. According to life insurance programs, guaranteed yield is usually absent, however, if, according to the results of 2020, the yield of accumulative life insurance certificates was in the range of 5.25% – 9.20%, then for investment life insurance certificates, the yield often exceeds 15%. However, it is necessary to remember that the fields of investment insurance of life do not have guaranteed profitability and annual income can be zero. This is due to different financial instruments that operate for insurers:

- accumulative life insurance – conservative financial instruments with minimal risks and less profitability;

- Investment life insurance – higher risky tools that can provide the greatest yield.

Such a separation is explained by the purpose of these products:

- accumulative life insurance – accumulation in the long term;

- Investment life insurance – a short time investment.

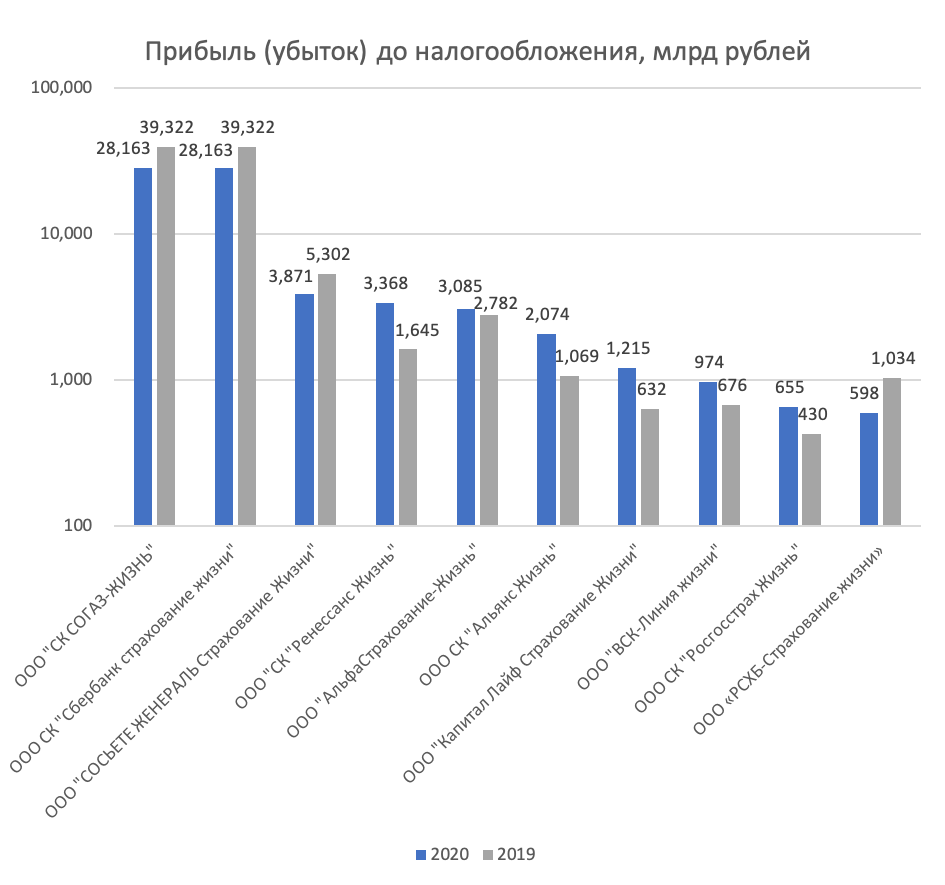

Thus, the net profit of insurance companies of “life” is formed by the effective operation of the investment unit. The chart below presents the profits to the top 10 insurers (in terms of signed premiums in 2020) in 2020 and 2019.

Comments of the editors

Crisis and Pandemic 2020 has shown that insurance companies have successfully overcome the challenges of the economy. As the Central Bank notes 135 organizations (from 160 valid) made a profit in 2020 – this is 84% of companies (in 2019 their share was 82%).

The losses of the top 10 in the “Life” segment of the Insurance activity in 2020 amounted to almost 26 billion rubles compared with profit of 3 billion rubles in 2019.

The resulting loss from insurance activities was compensated for by the profit of insurers from investment activities. Thus, in 2020, there was an increase in profit from investment activities Top-10 SK from 92 billion rubles in 2019 to 138 billion rubles in 2020, which was mainly caused by the re-valuation of foreign currency assets against the background of the weakening of the national currency rate.

At the same time, over the past year, the losses of companies increased by 58% (+67 billion rubles) and reached 181 billion rubles, and expenses for insurance activities increased by only 4% (+4 billion rubles) to 75.5 ml.

We will follow the financial results of insurance companies – stay with Calmins.com in order not to miss the following articles.

An article approved by an expert of the insurance market Denis Lebedev

Calmins.com ©