Insurance today: Analysis of Indicators of Insurance Companies According to the results of 2020

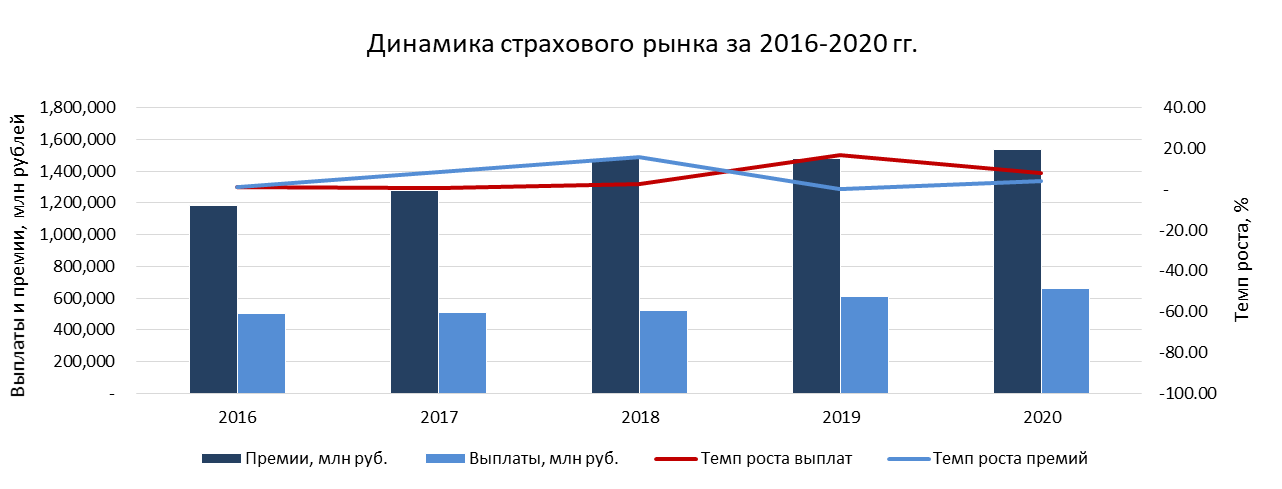

The Central Bank of Russia March 5, 2021 published statistical indicators of insurance companies in 2020. According to the previous year, the volume of signed premiums increased by 3.9%, and the volume of payments made increased by 7.8%.

You can get acquainted with other articles and reviews for previous and future periods in the heading # Market Analysis.

According to analysts of the Central Bank, the amounts are somewhat different: awards – an increase of 4.1%, payments – an increase of 8.1% to the results of 2019. And the general charges of the accrued premium reached almost 1, 54 billion rubles, and payments about 660 million rubles.

The discrepancy is associated with omission in the analyst of the Central Bank of the results of companies that were eliminated in 2020. In this analysis, we will correct this disadvantage and will conduct a complete review of the results.

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Premiums, mln. RUB. | 1,180,632 | 1,278,842 | 1,479,501 | 1,481,178 | 1,538,700 |

| Payments, mln. RUB | 505,790 | 509,542 | 523,189 | 610,741 | 658,648 |

| Premiums rate of growth, % | 8.32 | 15.69 | 0.11 | 3.88 | |

| Payments rate of growth, % | 0.74 | 2.68 | 16.73 | 7.84 |

Earlier in an exclusive interview with an expert of the insurance market, Doctor of Economics, Ph.D. Zubets A.N. we have already discussed the results of 2020 and the trends of 2021. Today’s analysis of the insurance market is the ordering and analysis of the primary statistics of the Central Bank of the Russian Federation.

2020, despite the pandemic, turned out to be a record both in terms of the collected premiums and in terms of the payments made.

General scorecard of 2020

The volume of signed premiums in 2020 amounted to 1.54 trillion rubles (against 1.48 trillion rubles in 2019), and the volume of payments made for the same period – 658.65 billion rubles (against 610.74 billion

| 2020 | 2019 | Changes, mln. RUB | Changes, % | |

| Premiums, mln. RUB | 1,538,700 | 1,481,178 | 57,523 | 4% |

| Payments, mln. RUB | 658,648 | 610,741 | 47,907 | 8% |

| Payments to premium ratio | 43% | 41% |

So, the top 10 companies on the gross fees accounts for 71% of the total fees in 2020 against 64% – in 2019. To increase the concentration led, first of all, the business association of insurance companies AO “VTB Life Insurance” In comparison with the results for 9 months, the concentration was not practically changed (72% at 9 months 2020).

Table-Rating Insurance Companies in terms of the accrued insurance premium in 2020 and 2019

| № | The volume of collected premiums by insurance companies, mln RUB | 2020 | 2019 | Changes, mln RUB | Changes, % |

| 1 | SC “SOGAZ” | 287,303 | 194,334 | 92,968 | 48% |

| 2 | SC “AlfaInsurance” | 114,880 | 108,353 | 6,528 | 6% |

| 3 | ISC “RESO-Guarantee” | 108,330 | 97,967 | 10,362 | 11% |

| 4 | IPJSC “Ingosstrakh” | 106,540 | 103,273 | 3,266 | 3% |

| 5 | LLS Insurance Company “Sberbank life insurance” | 106,097 | 153,419 | -47,323 | -31% |

| 6 | PC Insurance Company “Rossgostrakh” | 85,286 | 77,983 | 7,303 | 9% |

| 7 | LLC “AlfaInsuranceLife” | 84,934 | 55,767 | 29,168 | 52% |

| 8 | Insurance SC “VSC” | 80,830 | 82,209 | -1,380 | -2% |

| 9 | LLC “Insurance company SOGAZ-life” | 76,070 | 45,772 | 30,298 | 66% |

| 10 | LLC “Insurance company “Renaissance life” | 45,902 | 33,600 | 12,302 | 37% |

| Other companies | 442,528 | 528,499 | -85,971 | -16% | |

| Total | 1,538,700 | 1,481,178 | 57,523 | 4% |

In monetary terms, the top 10 companies collected 1.096 trillion rubles in 2020, showing an increase of 15% or 143 billion rubles in relation to the results of the previous year (953 billion rubles). Moreover, the fees of the VTB Group decreased for the year by 91 billion rubles – from the account of the account of the sales structure within the SOGAZ group in favor of Sogaz JSC and Insurance Company Sogaz-Life LLC.

The table below shows the statistics on insurance companies in 2020 and 2019.

| № | The volume of collected premiums by insurance companies, mln RUB | 2020 | 2019 | Changes, mln RUB | Changes, % | Market share 2020 | Market share 2019 |

| 1 | SOGAZ | 374,931 | 343,118 | 31,813 | 9% | 24% | 23% |

| 2 | AlfaInsurance | 199,815 | 164,119 | 35,695 | 22% | 13% | 11% |

| 3 | Sberbank Insurance | 127,358 | 173,171 | -45,813 | -26% | 8% | 12% |

| 4 | Ingosstrakh | 113,918 | 113,267 | 652 | 1% | 7% | 8% |

| 5 | RESO | 112,839 | 104,020 | 8,819 | 8% | 7% | 7% |

| 6 | Rossgostrakh | 105,280 | 91,735 | 13,544 | 15% | 7% | 6% |

| 7 | VSK | 88,542 | 91,527 | -2,985 | -3% | 6% | 6% |

| 8 | Renaissance | 82,961 | 69,594 | 13,367 | 19% | 5% | 5% |

| 9 | Soglasiye | 39,128 | 36,103 | 3,026 | 8% | 3% | 2% |

| 10 | Capital life insurance | 20,980 | 20,751 | 229 | 1% | 1% | 1% |

| Other companies | 272,948 | 273,773 | -825 | 0% | 18% | 18% | |

| Total | 1,538,700 | 1,481,178 | 57,523 | 4% | 100% | 100% |

The top 10 largest insurance groups aggregated 1.266 trillion rubles in 2020 and 1.207 trillion rubles in 2019, which is 82% of the total revenue of the entire insurance market of Russia in each year. Dynamics of fees in 10 insurance groups for the same period last year – plus 58.35 billion rubles (+ 5%). Thus, the concentration of the market in the top 10 companies remained unchanged and the fees amounted to 82% of total fees.

In more detail, the results of the largest insurers we will analyze in our following articles

The structure of the insurance market by types and its dynamics for 2020

Among all species life insurance only (universal life insurance + individual life insurance + the life of the borrower’s life) demonstrated an increase in market share (28% in 2020) – plus 1% by 2019. In 2020, the share of third party liability insurance and fully comprehensive insurance decreased by 1% and amounted to 14% and 11%, respectively.

For life insurance, we have recently published a large analysis of the life insurance market for 2020, where this topic is dismantled by an expert in the insurance market.

For other types of insurance, the market share has practically not changed (less than 1%).

The table of the accrued premium by type of insurance in dynamics of 2020 by 2019.

The volume of collected premiums by type of insurance, mln RUB | 2020 | 2019 | Changes, mln RUB | Changes, % | Market share 2020 | Market share 2019 |

| Life insurance | 333,701 | 315,766 | 17,935 | 6% | 22% | 21% |

| Third party liability insurance | 220,021 | 214,949 | 5,072 | 2% | 14% | 15% |

| Voluntary medical insurance (entities and individuals) | 176,965 | 180,655 | -3,690 | -2% | 12% | 12% |

| Accident and health insurance | 202,310 | 187,366 | 14,943 | 8% | 13% | 13% |

| Сomprehensive insurance (entities and individuals) | 175,423 | 170,547 | 4,876 | 3% | 11% | 12% |

| Voluntary property and casualty insurance (entities) | 113,143 | 103,322 | 9,820 | 10% | 7% | 7% |

| Life insurance of the Borrower | 94,548 | 91,491 | 3,057 | 3% | 6% | 6% |

| Voluntary property and casualty insurance (individuals) | 71,650 | 71,901 | -250 | 0% | 5% | 5% |

| Business and finance insurance | 42,649 | 44,491 | -1,842 | -4% | 3% | 3% |

| Voluntary third party liability insurance | 35,844 | 32,283 | 3,560 | 11% | 2% | 2% |

| Other types of insurance of enteties property (including “marine”, “avia”, “cargo”, “railway” и “agricultural” insurance) | 47,067 | 43,538 | 3,530 | 8% | 3% | 3% |

| National service life insurance | 16,837 | 15,688 | 1,149 | 7% | 1% | 1% |

| Other types of insurance | 8,543 | 9,180 | -638 | -7% | 1% | 1% |

| Total | 1,538,700 | 1,481,178 | 57,523 | 4% |

As before, the greatest fees and the greatest growth demonstrates auto insurance (third party liability insurance + fully comprehensive insurance), which accounts for 25% of the 2020 market (27% – in 2019). The volume of third party liability insurance and fully comprehensive insurance fees in total is 354.39 billion rubles.

Life insurance (universal life insurance + individual life insurance + Life Insurance of the Borrower) in 2020, he showed an increase (+ 6% or +17.94 billion rubles) and amounted to 333.70 billion rubles. Read more about the reasons for growth and changes, read in our article Analysis of the life insurance market for 2020.

Voluntary health insurance fees decreased by 3.69 billion rubles (minus 2%) and amounted to 176.97 billion rubles. In 2020, travel business in Russia has suffered significantly due to the restrictive measures and the border closure of most countries. Therefore traveler insurance (insurance) fell, as well as an additional negative effect provided partial translation of this direction in banking equipment the following product – Accidents and disease insurance – funded insurance (foremost the companies: Rossgostrakh, AlfaInsurance, SOGAZ). Fees in insurance against accidents and illnesses increased by 14.94 billion rubles (+ 8%) and amounted to 202.31 billion rubles. Also, growth is partly due to the emergence of new products by anticoronevirus type.

Voluntary insurance of property of legal entities increased by 9.82 billion rubles (+ 10%) and amounted to 113.14 billion rubles, and the insurance of legal entities – on the contrary – has almost changed (-250 million rubles) and amounted to 71.65 mlrd. RUB.

The volume of entrepreneurial risk insurance fees decreased by 1.84 billion rubles (-4%) and amounted to 42.65 billion rubles. The reduction is due to a decline in risk of risk from the unbearable, as well as the transfer of part of the insurance of financial risks of individuals in the insurance products from accidents, and the insurance of property and civil liability of citizens’ Voluntary civil liability insurance

Voluntary insurance of civil liability and other insurance of legal entities amounted to 35.84 billion rubles and 47.07 billion rubles, respectively, demonstrating 11% and 8% growth.

The table below provides information on the number of signed certificates in 2020 and the dynamics to full 2019.

Amount of signed certificates, pieces | 2020 | 2019 | Changes, pieces | Changes, % |

| Third party liability insurance | 39,659,499 | 39,691,288 | -31,789 | 0% |

| Voluntary medical insurance (entities and individuals) | 10,730,002 | 17,033,842 | -6,303,840 | -37% |

| Accident and health insurance | 39,886,810 | 55,158,256 | -15,271,446 | -28% |

| Сomprehensive insurance (entities and individuals) | 5,244,630 | 4,934,083 | 310,547 | 6% |

| Life insurance | 1,362,935 | 1,278,098 | 84,837 | 7% |

| Voluntary property and casualty insurance (entities) | 409,601 | 440,595 | -30,994 | -7% |

| Life insurance of the Borrower | 4,012,893 | 3,927,961 | 84,932 | 2% |

| Voluntary property and casualty insurance (individuals) | 43,219,929 | 48,790,230 | -5,570,301 | -11% |

| Business and finance insurance | 15,538,559 | 20,172,798 | -4,634,239 | -23% |

| Voluntary third party liability insurance | 10,964,167 | 12,708,129 | -1,743,962 | -14% |

| Other types of insurance of enteties property (including “marine”, “avia”, “cargo”, “railway” и “agricultural” insurance) | 3,779,604 | 3,674,525 | 105,079 | 3% |

| Other types of insurance | 296,161 | 299,954 | -3,793 | -1% |

| Total | 175,104,801 | 208,109,768 | -33,004,967 | -16% |

Among all types of insurance, the number of prisoners of the third party liability insurance contracts did not change, since this type of insurance is mandatory, and even despite the pandemic insurers managed to collect the third party liability insurance awards by passing online.

The number of voluntary medical insurance contracts decreased by 37%, and the average bonus increased by 56% by reducing the volumes of cheaper (relatively standard voluntary medical insurance policies) of insurance of traveling abroad.

The capacity of fully comprehensive insurance contracts increased by 6%, and the average premium decreased by 3%, which is explained by the increase in the number of mini fully comprehensive insurance contracts and contracts with a monthly period of responsibility with a lower cost of relatively full-fledged products.

The number of signed of life insurance contracts increased by 7%, while the average fee decreased by 1%. Within 2020, insurance premiums on life insurance products vary significantly.

For more information about changes in these and other types of insurance, read in our following articles heading # Market Analysis.

Average premium of products, RUB | 2020 | 2019 | Changes, RUB | Changes, % |

| third party liability insurance | 5,548 | 5,416 | 132 | 2% |

| Voluntary medical insurance (entities and individuals) | 16,493 | 10,606 | 5,887 | 56% |

| Accident and health insurance | 5,072 | 3,397 | 1,675 | 49% |

| Сomprehensive insurance (entities and individuals) | 33,448 | 34,565 | -1,117 | -3% |

| Life insurance | 244,840 | 247,060 | -2,220 | -1% |

| Voluntary property and casualty insurance (entities) | 276,226 | 234,506 | 41,720 | 18% |

| Life insurance of the Borrower | 23,561 | 23,292 | 269 | 1% |

| Voluntary property and casualty insurance (individuals) | 1,658 | 1,474 | 184 | 12% |

| Business and finance insurance | 2,745 | 2,205 | 539 | 24% |

| Voluntary third party liability insurance | 3,269 | 2,540 | 729 | 29% |

| Other types of insurance of enteties property (including “marine”, “avia”, “cargo”, “railway” и “agricultural” insurance) | 12,453 | 11,849 | 604 | 5% |

Indicators of the insurance companies of the LIFE segment

For 2020 companies of “Life” segment collected 456.83 billion rubles of premiums, showing the growth of 3% on the results of 2019 (442.07 billion rubles).

The table below shows the top 10 companies licensed for life insurance.

| № | Average premium of life segment, RUB | 2020 | 2019 | Changes, RUB | Changes, % |

| 1 | LLS Insurance Company “Sberbank life insurance” | 106,097 | 153,419 | -47,323 | -31% |

| 2 | LLC “AlfaInsuranceLife | 84,934 | 55,767 | 29,168 | 52% |

| 3 | LLC “Insurance company SOGAZ-life” | 76,070 | 45,772 | 30,298 | 66% |

| 4 | LLC “Insurance company “Renaissance life” | 45,902 | 33,600 | 12,302 | 37% |

| 5 | LLC “Capital life – life insurance” | 20,980 | 20,751 | 229 | 1% |

| 6 | LLC Insurance Company “Rossgostrakh Life” | 19,993 | 13,752 | 6,241 | 45% |

| 7 | LLC Insurance Company “Alliance Life” | 15,150 | 12,149 | 3,001 | 25% |

| 8 | LLC “Societe Generali Life Insurance” | 11,963 | 14,857 | -2,894 | -19% |

| 9 | LLC «RSHB-Life Insurance» | 11,875 | 8,099 | 3,776 | 47% |

| 10 | LLC “Insurance Company “SiV life” | 6,978 | 9,061 | -2,084 | -23% |

| Other Companies | 56,887 | 74,845 | -17,958 | -24% | |

| Total | 456,828 | 442,072 | 14,756 | 3% |

As it was earlier, the first place in the collection in the life insurance segment is occupied by LLC Sberbank Life Insurance, even despite 31% drop in fees for the year. AlfaInsurance-Life LLC (+29.17 billion rubles or + 52%), OOO “SK SOGAZ-LIFE” (+30.30 billion rubles or + 66%), LLC “SK” Renaissance LLC (+12.30 billion rubles or + 37%), IC Rosgosstrakh Life LLC (+6.24 billion rubles or + 45%), Insurance Company Alliance Life LLC (+3 billion rubles or + 25%), RSHB-Insurance LLC life ”(+3.78 billion rubles or + 47%).

In more detail, only 2020 life insurance and results are available in the article Analysis of the life insurance market for 2020.

Indicators of the Insurance Companies of the Non-Life segment

The companies of “Non-Life” segment in 2020 collected 1.08 trillion rubles, demonstrating growth plus 4% regarding fees in 2019 (1.04 trillion rubles).

The table below shows the top 10 companies of the “not life” segment.

| № | Average premium of not life segment, RUB | 2020 | 2019 | Changes, RUB | Changes, % |

| 1 | SC “SOGAZ” | 287,303 | 194,334 | 92,968 | 48% |

| 2 | SC “AlfaInsurance” | 114,880 | 108,353 | 6,528 | 6% |

| 3 | ISC “RESO-Guarantee” | 108,330 | 97,967 | 10,362 | 11% |

| 4 | IPJSC “Ingosstrakh” | 106,540 | 103,273 | 3,266 | 3% |

| 5 | PC Insurance Company “Rossgostrakh” | 85,286 | 77,983 | 7,303 | 9% |

| 6 | Insurance SC “VSC” | 80,830 | 82,209 | -1,380 | -2% |

| 7 | PC “Group Renaissance insurance” | 35,973 | 34,838 | 1,135 | 3% |

| 8 | LLC “Insurance company “Soglasiye” | 34,282 | 32,929 | 1,353 | 4% |

| 9 | LLS Insurance Company “Sberbank insurance” | 21,262 | 19,752 | 1,510 | 8% |

| 10 | PC “Tinkoff Insurance” | 18,614 | 16,429 | 2,185 | 13% |

| Other companies | 188,573 | 271,037 | -82,464 | -30% | |

| Total | 1,081,872 | 1,039,105 | 42,767 | 4% |

The greatest growth of the collected premiums showed SOGAZ JSC (+92.97 billion rubles or + 48%), mainly due to the accession of the portfolio of IC “VTB insurance”. For other companies, Top-10 also has an increase in fees, with the exception of CJSC “VSK” – the fall of the premiums was 1.38 billion rubles or 2%.

In more detail, the results of the activities of the companies of the segments “Life” and “Not Life” we will consider in further reviews in the heading # Market Analysis.

Summary

Despite the Pandemic, the following lockdown and restrictive measures from the Government of the Russian Federation, the insurance market managed not only to keep positions, but also show 4% growth in 2020. The initial forecasts were disappointing.

So the company “Life” segment increased the amount of collected awards by 3%, and the “Non-Life” segment increased by 4%.

The most “cash” types of insurance were

- auto insurance (354.39 billion rubles) and

- life insurance (333.70 billion rubles).

And the greatest decline (minus 3.69 billion rubles) has demonstrated voluntary medical insurance, the volume of charges of which amounted to 176.97 billion rubles in 2020.

Earlier in our article, the insurance market of Russia 2020: the growth of 4% instead of the fall, we described in detail about the situation and compared our forecasts with the fact of last year. It turned out that in many ways we were right.

You can order a detailed analysis of the Russian market for 2020 (RUS / ENG) with infographics by writing to info@calmins.com.

Stay with us on the information and analytical portal Calmins.com! Ahead of you waits many reviews and analyzes of the market!

Article obtained by expert insurance market Denis Lebedev

Calmins.com ©