Key factors of growth of the Russian insurance market in 2021 and the forecast of Calmins.com. On March 15, 2022, the Central Bank of the Russian Federation published data on the main indicators of the insurance market in Russia. Total fees exceeded 1.8 trillion rubles. In our article, we will discuss key factors that influenced the achievement of such high results, especially after the coronavirus pandemic. These are the highest rates in the history of the insurance market in our country.

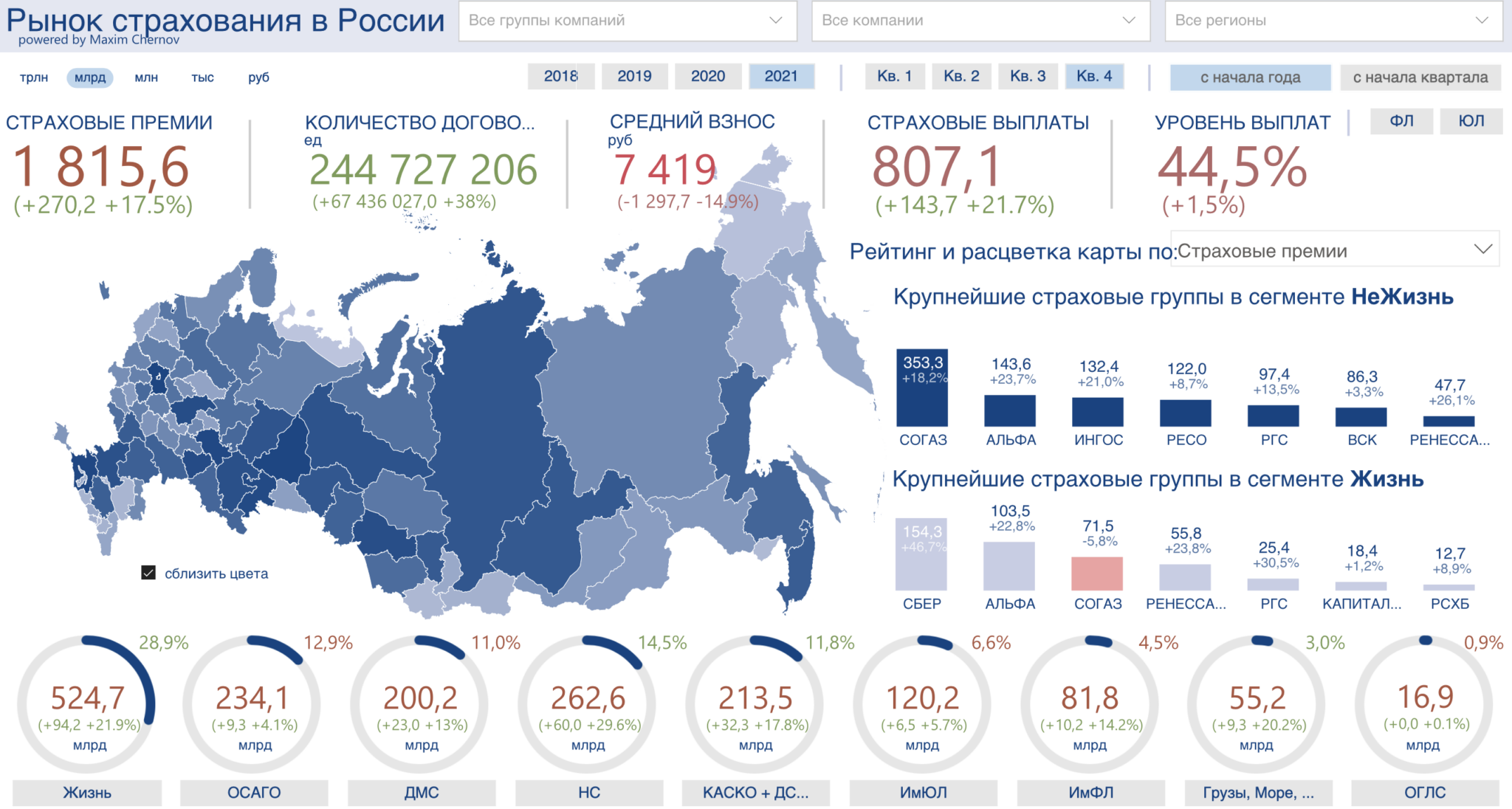

For your convenience, we turn to infographics that were developed by the expert of the insurance market Maxim Chernov. Information tables are located on our resource under the heading of the insurance market. They also take into account the fees of companies which licenses were recalled over the past year.

Comparison of key indicators of the insurance market in Russia: CBR data vs forecast Calmins.com

Earlier in our article of December last year, 10 major insurance events in Russia 2021 – the expert’s opinion, we gave a closure forecast and the main indicators for the final fees in the context of insurance types over the past year.

It should be noted that our forecast was almost fully confirmed. According to our assessment, the insurance market in the Russian Federation was supposed to grow to 1.82 trillion rubles, however, the collected insurance premium was slightly lower than the forecast – 1.815 trillion rubles (according to the Central Bank of the Russian Federation).

We expected that the general fees for the life insurance market reached 550 billion rubles, as well as the All-Russian Insurance Association, which at a press conference in February of this year indicated the same meaning. However, the Bank of Russia figures are slightly more modest – 525 billion rubles. Most likely, the All-Russian Insurance Association assessed the final fees (with VHI and accumulative insurance) for the companies of the “Life” segment. The decrease in fees in the 4th quarter for life insurance was associated with a slowdown in lending and an increase in the Bank of Russia key rate, which to some extent reduced the attractiveness of long-term accumulative life insurance and Individual life insuranbce programs.

Car insurance fees, in our estimation, should have amounted to 450 billion rubles with actual data 448 billion rubles.

The voluntary medical insurance market turned out to be more than 200 billion rubles, with our more modest forecast of 195 billion rubles.

Individual property insurance amounted to 82 billion rubles with our preliminary valuation of 85 billion rubles.

General insurance against accident and disease – 263 billion rubles with our forecast of 265 billion rubles.

Thus, we were right with assessing the growth of the Russian insurance market in 2021, both in general and along the main key business lines.

Factors of key changes in the insurance market of Russia in 2021

The main increase in insurance premium is noted in life insurance, primarily due to credit life insurance (through banks), as well as due to rapid growth of accumulative life insurance and positive dynamics of individual life insurance – plus 94 billion rubles (+ 22%). Accident and illness insurance showed an increase in the premium of 60 billion rubles (+ 30%), which was also provided with a life insurance.

fully comprehensive insuranceshowed good dynamics – plus 32 billion rubles (+ 18%), VHI – 23 billion rubles (+ 13%) and financial risks – 12 billion rubles.

Insurance groups that provided the maximum increase in insurance premiums:

SberInsurance – 54 billion rubles

SOGAZ – 50 billion rubles

Alfa insurance – almost 47 billion rubles

Ingosstrakh – 24 billion rubles

Renaissance insurance – more than 20 billion rubles

Rosgosstrakh – more than 17 billion rubles

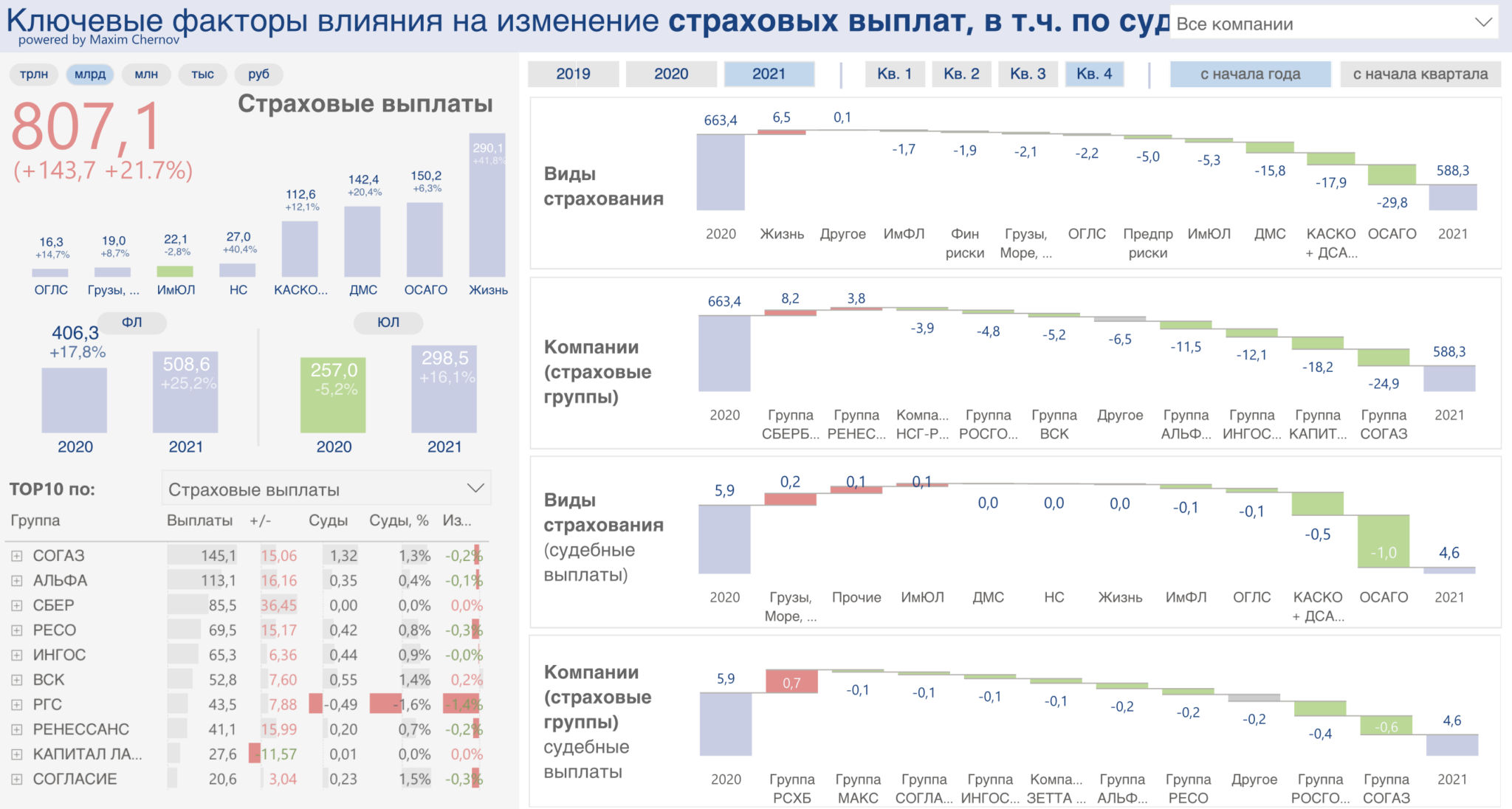

Insurance payments exceeded 800 billion rubles, and the share of payments increased by 1.5 to 44.5%, which indicates an increase in loss-making in the whole market.

The most contribution was made by such types of insurance as third party liability insurance – plus almost 30 billion rubles, and fully comprehensive insurance – plus 18 billion rubles. This was due to a decrease in car insurance losses in 2020 amid the coronavirus and lockdown pandemic.

A similar situation for VHI, since customers began to undergo more active treatment last year and use voluntary medical insurance policies, the growth in payments amounted to almost 16 billion rubles.

The maximum increase in losses was shown by insurance companies SOGAZ (+0.6 billion rubles) and Rosgosstrakh (+0.4 billion rubles).

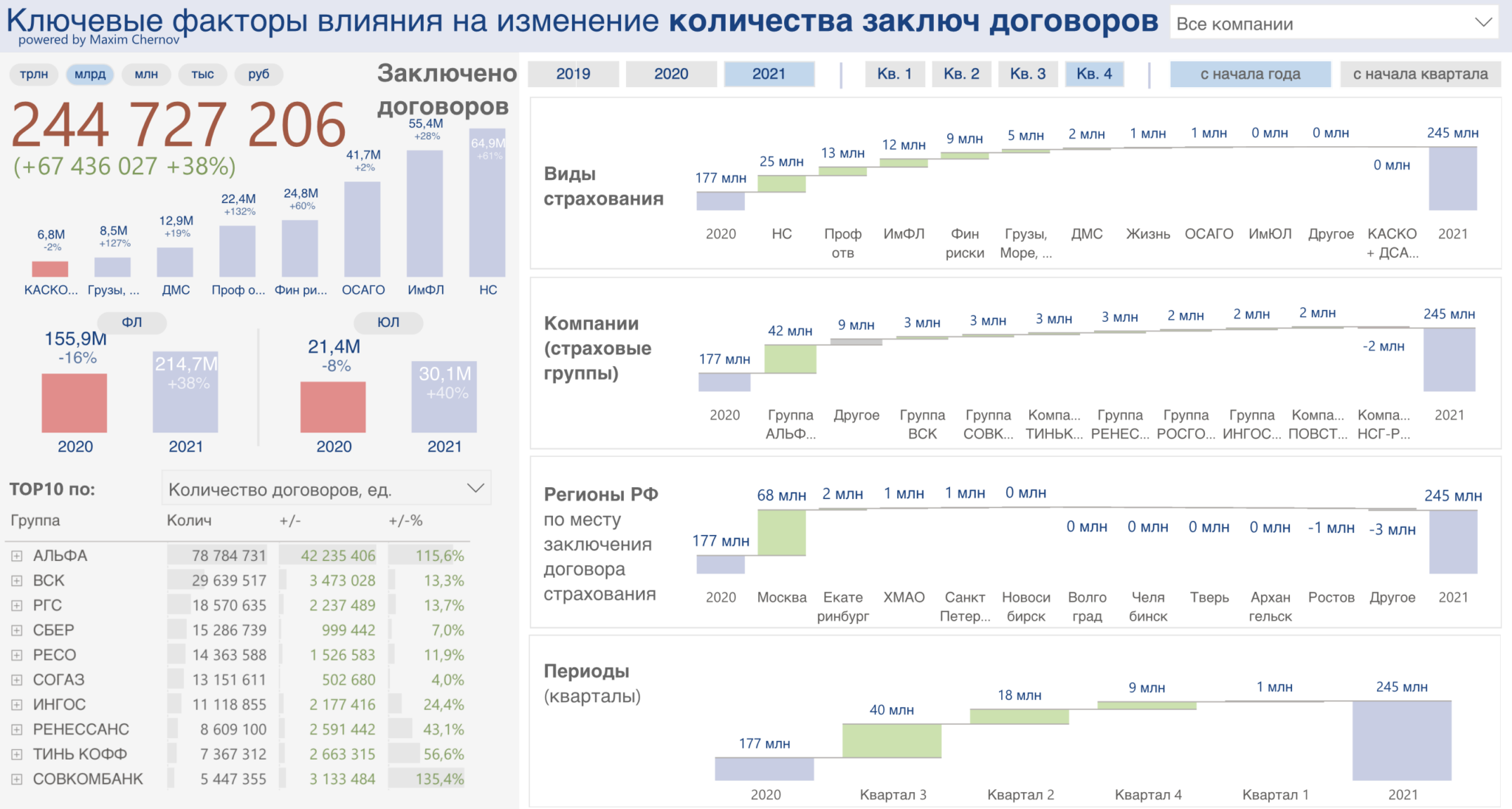

The total number of concluded insurance contracts in 2021 increased by 38% – up to almost 245 million units. The main increase (by 25 million units) occurred in insurance against accidents and illnesses (credit insurance), professional liability (plus 13 million units), insurance of citizens’ property – IFL (plus 12 million units) due to sales of boxed products through intermediaries, including banks, insurance of financial risks (plus 9 million units), cargo / sea and air insurance million pieces and VHI (plus 2 million pieces).

Among insurance companies there is a maximum increase in alpha insurance. Most likely, due to the reformatting of contracts with legal entities (fragmentation) and the rapid development of credit insurance within the group. VSK and Sovcombank Insurance has grown by 3 million units of contracts each.

Summary

2021 was very successful for the Russian insurance market, showing the highest dynamics in the last 5 years.

The year 2022 will be more difficult for everyone against the background of recent geopolitical events. In more detail, our forecasts for the current year we discussed in the article What awaits the insurance market in Russia in 2022? According to our estimates, most likely, fees may decrease by 15% in ruble terms. Reducing lending to the population at a high cost of loans, in fact, freezing mortgages, reducing car sales will negatively affect the future results of the insurance market 2022.

However, there are all prerequisites to remain in the current fees of the insurance premium – 1.8 trillion rubles even in 2022.

Much will depend on the duration of the special operation, the rapid response of insurers to changes (modification of product lines, a change in the approach to payments in auto insurance, etc.), and the actions of the regulator – the Central Bank of the Russian Federation (protection of accumulations for NSH and ICF in the insurers), as well as situations with the solvency of the population – clients of insurance companies.

Updating information on the Russian market, insurance yesterday, today and tomorrow in the headings of the market analysis and copyright articles.

The latest insurance news, market analysis and forecasts on the information and analytical resource Calmins.com – deliberate insurance!

The article was approved by the expert of the insurance market Denis Lebedev

Calmins.com ©